Question: A company has one non-current liability which is the only liability on which interest is charged. This is a 25 year mortgage over its real

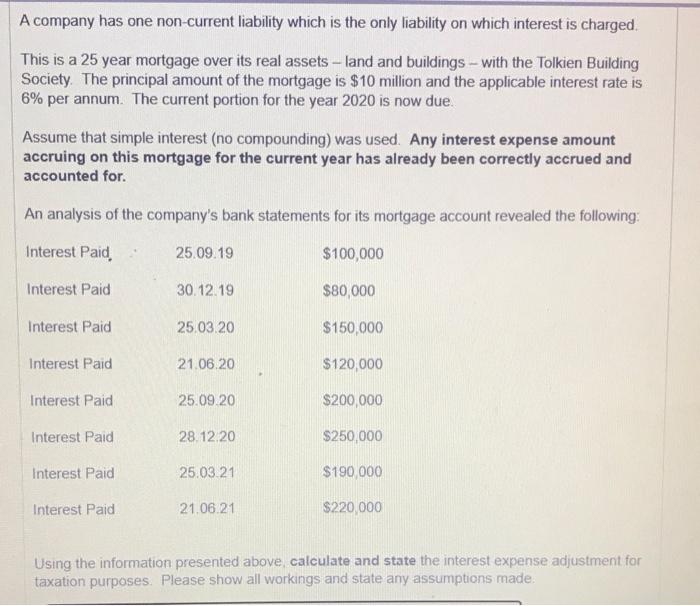

A company has one non-current liability which is the only liability on which interest is charged. This is a 25 year mortgage over its real assets - land and buildings - with the Tolkien Building Society. The principal amount of the mortgage is $10 million and the applicable interest rate is 6% per annum. The current portion for the year 2020 is now due. Assume that simple interest (no compounding) was used. Any interest expense amount accruing on this mortgage for the current year has already been correctly accrued and accounted for. An analysis of the company's bank statements for its mortgage account revealed the following: Interest Paid 25.09.19 $100,000 Interest Paid 30.12.19 $80,000 Interest Paid 25.03.20 $150,000 Interest Paid 21.06.20 $120,000 Interest Paid 25.09.20 $200,000 Interest Paid 28.12.20 $250,000 Interest Paid 25.03 21 $190,000 Interest Paid 21.06.21 $220,000 Using the information presented above calculate and state the interest expense adjustment for taxation purposes. Please show all workings and state any assumptions made

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts