Question: A company i s considering three vendors for purchasing a C R M system: Delphi Inc., C R M International, and Murray Analytics. The costs

A company considering three vendors for purchasing a system: Delphi Inc., International, and Murray Analytics. The costs the system are

expected depend the length time required implement the system, which depends such factors the amount customization required,

integration with legacy systems, resistance change, and Each vendor has different expertise handling these things, which affect the cost. The costs

millions $ are shown below for short, medium, and long implementation durations. Use the Excel template Decision Analysis identify what vendor

select.

answers the nearest cent.

Calculate the amounts foregone not adopting the optimal course action for each possible implementation duration. Determine the maximum opportunity

for each alternative. Fill the table below. your answer zero, enter Round your answers the nearest cent.

Opportunity Loss Matrix

Future events Suzy's Temporary Employee business, located a big city, can online criminal background check house for $ per search with a fixed cost

$ A thirdparty online security firm offered a similar security search for $ per person with annual service contract with STE. STE's

forecast searches next year, should STE continue the search house accept the thirdparty offer? Use the Excel template BreakEven

determine the best decision. Round your answer for the breakeven quantity the nearest whole number and round your answer for the amount savinoss

the nearest dollar.

Breakeven quantity:

searches

Since the demand forecast searches

than the breakeven quantity, STE

outsource the work. STE

$

outsourcing. Southland Corporation's decision produce a new line recreational products has resulted the need choose one two automated manufacturing

systems based proposals from two vendors, A and The economics this decision depends the market reaction the new product line. The possible

longrun demand has been defined low, medium, high. Based detailed financial analyses system costs a function volume and sales under each

demand scenario, the following payoff table gives the projected profits millions dollars.

LongRun Demand

Determine the best decisions using the maximax, maximin, and opportunity loss decision criteria.

Using the maximax criterion, choose

Using the maximin criterion, choose

minimize the maximum opportunity loss, choose

Assume that the best estimate the probability low longrun demand medium longrun demand and high longrun demand

What the best decision using the expected value criterion? Round your answers two decimal places.

The expected payoff for Vendor $

million.

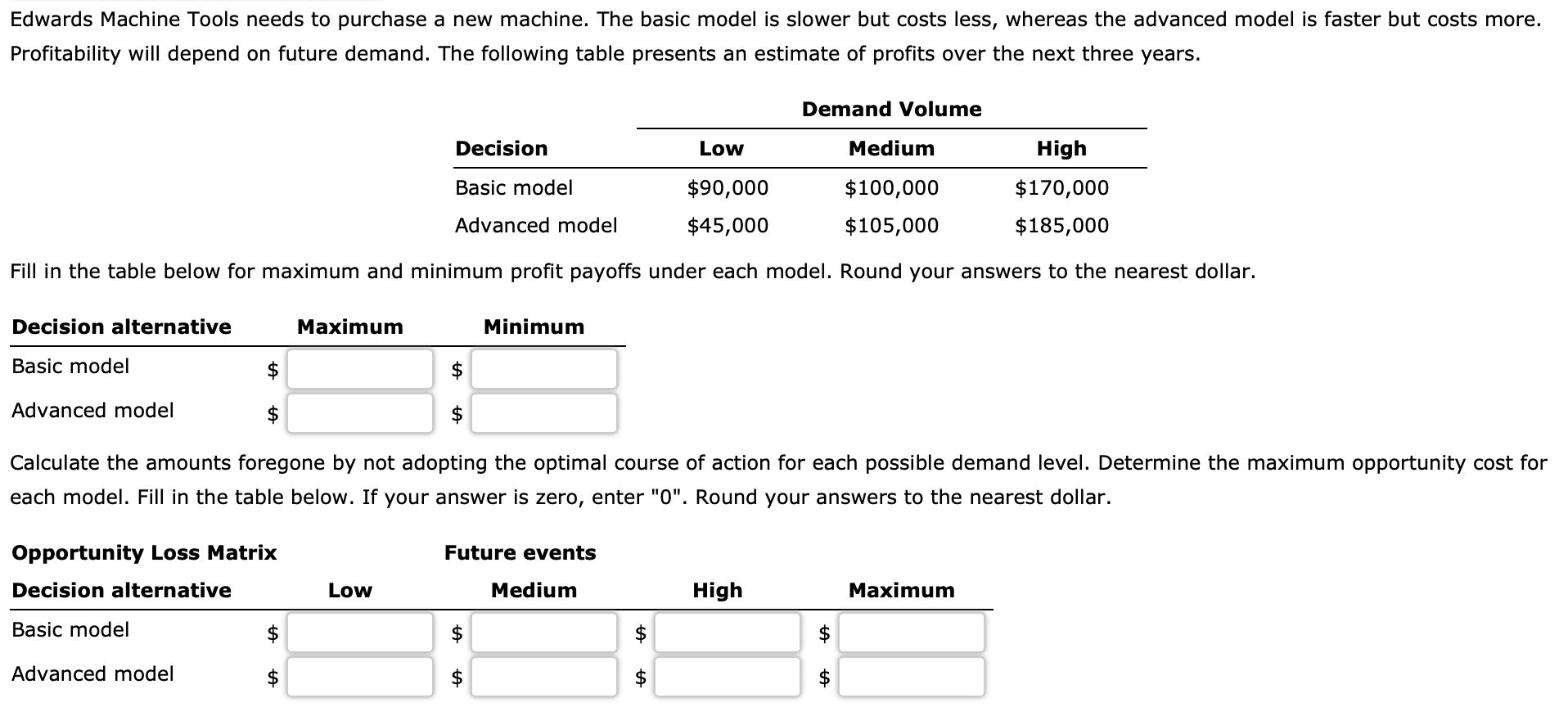

The expected payoff for Vendor The Edwards Machine Tools needs purchase a new machine. The basic model slower but costs less, whereas the advanced model faster but costs more.

Profitability will depend future demand. The following table presents estimate profits over the next three years.

Demand Volume

Fill the table below for maximum and minimum profit payoffs under each model. Round your answers the nearest dollar.

Decision alternative

Maximum

Basic model

Advanced model

Calculate the amounts foregone not adopting the optimal course action for each possible demand level. Determine the maximum opportunity cost for

each model. Fill the table below. your answer zero, enter Round your answers the nearest dollar.

Opportunity Loss Matrix

Future events

Decision alternative

Low

Medium

High

Maximum

Basic model

Advanced model

$

$

$

$

$Edwards Machine Tools needs purchase a new machine. The basic model slower but costs less, while the advanced model faster but costs more. Profitability will depend future demand. The following table presents estimate profits over the next three years.

Demand Volume

Decision Low Medium High

Basic model $ $ $

Advanced model $ $ $

The data has been collected the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis answer the questions below.

Open spreadsheet

Given the uncertainty associated with the demand volume, and other information work with, how would you make a decision using maximax and maximin criteria?

Maximax Decision:

Maximin Decision:

Using the minimax regret criterion, calculate the maximum opportunity loss for each alternative and make a decision.

Decision Maximum Opportunity Loss

Basic model $ fill the blank

Advanced model $ fill the blank The selling price per box for Cynthia's Cookies $ Fixed costs are $ and the variable cost per box $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock