Question: A company is analyzing a proposed 3-year project using standard sensitivity analysis. The company expects to sell 18,000 units, +4 percent. The expected variable cost

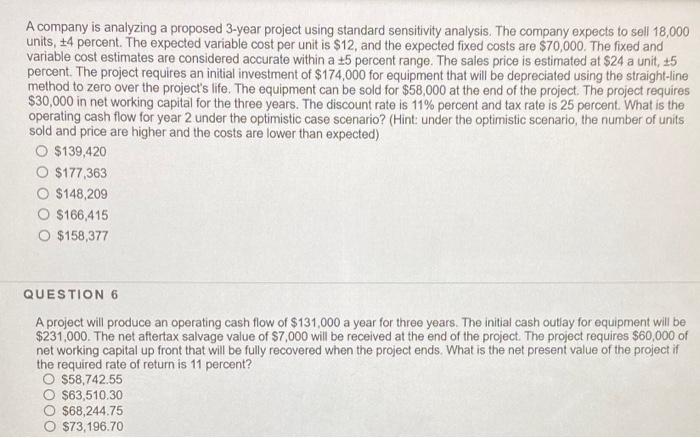

A company is analyzing a proposed 3-year project using standard sensitivity analysis. The company expects to sell 18,000 units, +4 percent. The expected variable cost per unit is $12, and the expected fixed costs are $70,000. The fixed and variable cost estimates are considered accurate within a +5 percent range. The sales price is estimated at $24 a unit, 15 percent. The project requires an initial investment of $174,000 for equipment that will be depreciated using the straight-line method to zero over the project's life. The equipment can be sold for $58,000 at the end of the project. The project requires $30,000 in net working capital for the three years. The discount rate is 11% percent and tax rate is 25 percent. What is the operating cash flow for year 2 under the optimistic case scenario? (Hint: under the optimistic scenario, the number of units sold and price are higher and the costs are lower than expected) O $139,420 O $177,363 O $148,209 O $166,415 O $158,377 QUESTION 6 A project will produce an operating cash flow of $131,000 a year for three years. The initial cash outlay for equipment will be $231,000. The net aftertax salvage value of $7,000 will be received at the end of the project. The project requires $60,000 of net working capital up front that will be fully recovered when the project ends. What is the net present value of the project if the required rate of return is 11 percent? O $58,742.55 O $63,510.30 $68,244.75 $73,196.70

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts