Question: A company is analyzing two mutually exclusive alternatives for purchase. Alternative A has the initial investment of $150,000 with an annual revenue of $25,000 per

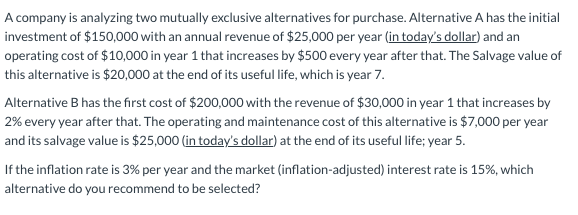

A company is analyzing two mutually exclusive alternatives for purchase. Alternative A has the initial investment of $150,000 with an annual revenue of $25,000 per year (in today's dollar) and an operating cost of $10,000 in year 1 that increases by $500 every year after that. The Salvage value of this alternative is $20,000 at the end of its useful life, which is year 7. Alternative B has the first cost of $200,000 with the revenue of $30,000 in year 1 that increases by 2% every year after that. The operating and maintenance cost of this alternative is $7,000 per year and its salvage value is $25,000 (in today's dollar) at the end of its useful life; year 5. If the inflation rate is 3% per year and the market (inflation-adjusted) interest rate is 15%, which alternative do you recommend to be selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts