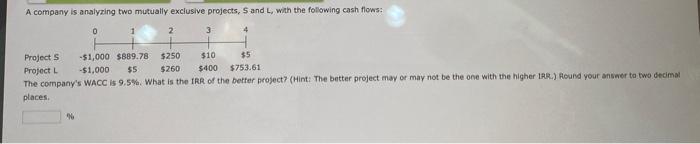

Question: A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 3 Projects -$1,000 $889.78 $250 $10 $5 Project

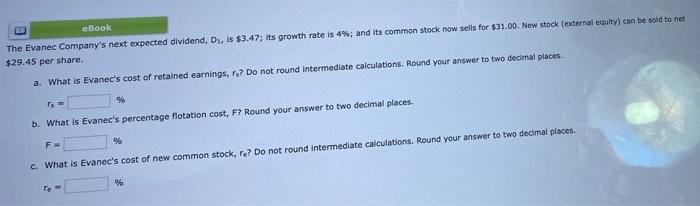

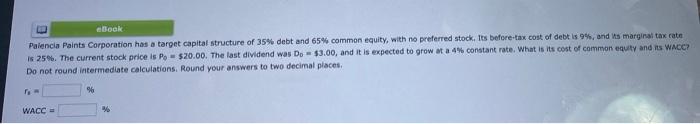

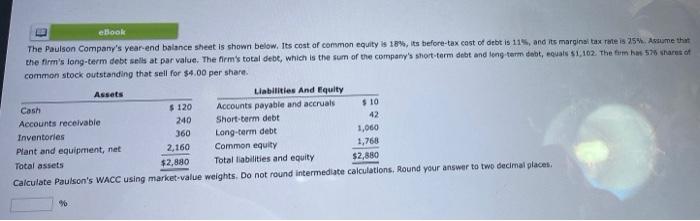

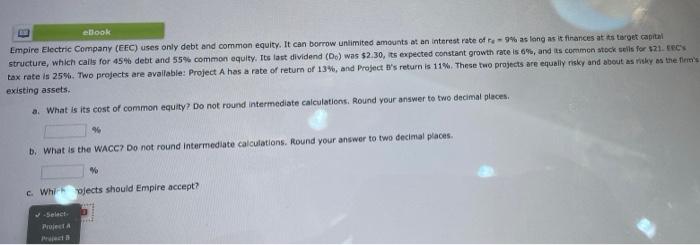

A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 3 Projects -$1,000 $889.78 $250 $10 $5 Project -$1,000 $5 $260 $400 $753.61 The company's WACC is 9.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimet places eBook The Evanec Company's next expected dividend, Di, is $3.47; its growth rate is 4%; and its common stock now sells for $31.00. New stock (external equity can be sold to net $29.45 per share. a. What is Evanec's cost of retained earnings, 17 Do not round intermediate calculations. Round your answer to two decimal places 96 b. What is Evanec's percentage flotation cost, F? Round your answer to two decimal places. 96 F c. What is Evanec's cost of new common stock, re? Do not round Intermediate calculations. Round your answer to two decimal places % eBook Palencia Paints Corporation has a target capital structure of 35% debt and 65% common equity, with no preferred stock. Its before-tax cost of debt is 9%, and is marginal tax rate Is 25%. The current stock price is P - $20.00. The last dividend was Dp = $3.00, and it is expected to grow at a 4% constant rate. What is its cost of common equity and its WACC? Do not round intermediate calculations. Round your answers to two decimal places 96 WACC ebook The Paulson Company's year end balance sheet is shown below. Its cost of common equity is 18%, its before-tax cost of debt is 115, and its marginal tax rate is 25% Astume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long term debt, equals 1.102. The form 576 shares of common stock outstanding that sell for $4.00 per share Assets Liabilities And Equity Cash $ 120 Accounts payable and accruals $ 10 Accounts receivable 240 Short-term debt 42 Inventories 360 Long-term debt 1,060 Plant and equipment, net 2,160 Common equity 1,768 Total assets $2,880 Total liabilities and equity $2,880 Calculate Paulson's WACC using market value weights. Do not round intermediate calculations, Round your answer to two decimal places, ebook Empire Electric Company (EEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of -9% as long as it finances at ts target capital structure, which calls for 45% debt and 55% common equity. Its tast dividend (D) was $2.30, its expected constant growth rate is 6%, and its common stock wells for $21. RCS tax rate is 25%. Two projects are available: Project A has a rate of return of 13%, and Project b's return is 11%. These two projects are equally risky and about as my as the firm's existing assets. a. What is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places 46 b. What is the WACC? Do not round Intermediate calculations. Round your answer to two decimal places c. Whjects should Empire accept? Select PA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts