Question: A company is analyzing two mutually-exclusive service projects using total investment analysis. MARR=22%. Project A is a system that has an estimated useful life of

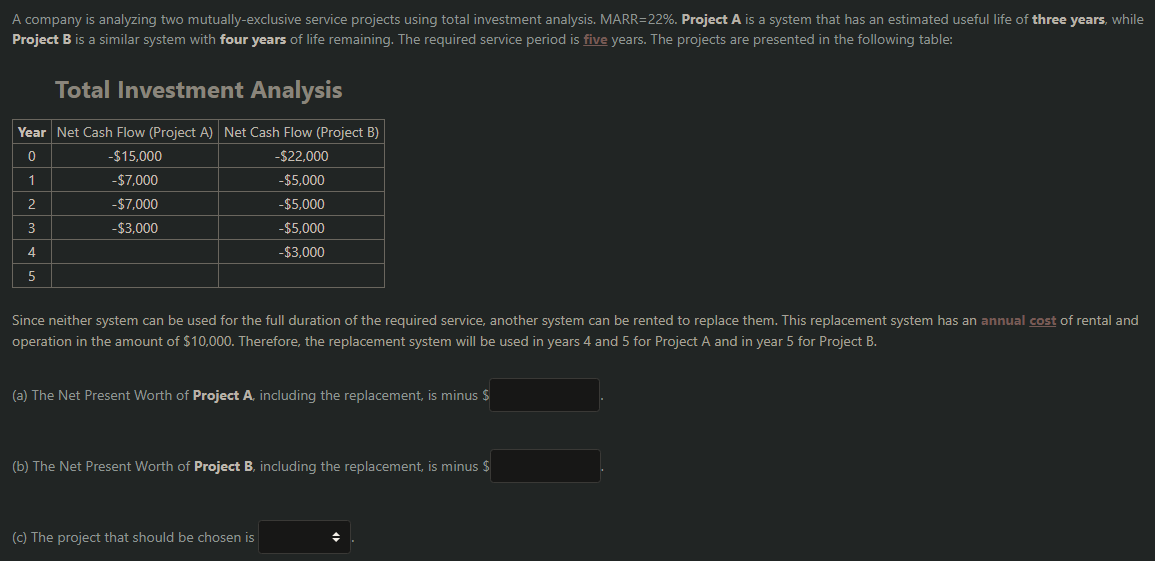

A company is analyzing two mutually-exclusive service projects using total investment analysis. MARR=22%. Project A is a system that has an estimated useful life of three years, while Project B is a similar system with four years of life remaining. The required service period is five years. The projects are presented in the following table: Total Investment Analysis Year Net Cash Flow (Project A) Net Cash Flow (Project B) 0 -$15,000 -$22,000 1 -$7,000 -$5,000 2 -$7,000 -$5,000 3 -$3,000 -$5,000 4 -$3,000 5 Since neither system can be used for the full duration of the required service, another system can be rented to replace them. This replacement system has an annual cost of rental and operation in the amount of $10,000. Therefore, the replacement system will be used in years 4 and 5 for Project A and in year 5 for Project B. (a) The Net Present Worth of Project A, including the replacement, is minus $ (b) The Net Present Worth of Project B, including the replacement, is minus $ (c) The project that should be chosen is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts