Question: A company is considering 5 mutually exclusive projects. In considering these projects, the firm knows A) These cannot be financing projects. B) The acceptance of

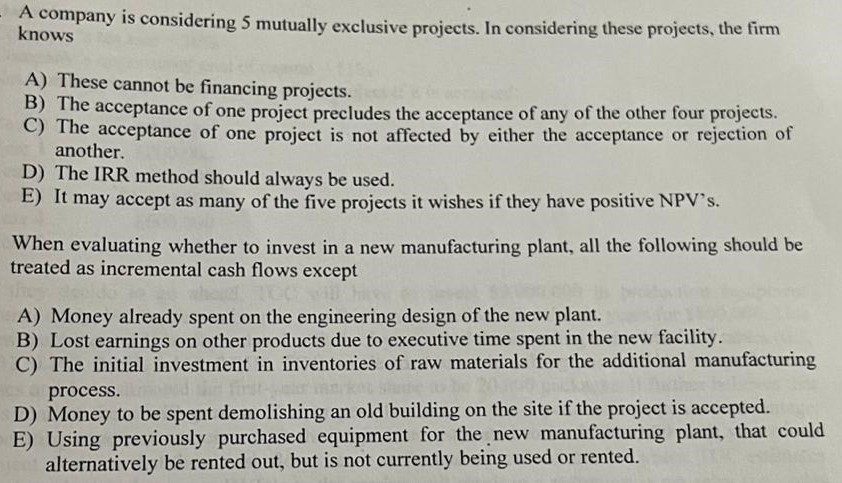

A company is considering 5 mutually exclusive projects. In considering these projects, the firm knows A) These cannot be financing projects. B) The acceptance of one project precludes the acceptance of any of the other four projects. C) The acceptance of one project is not affected by either the acceptance or rejection of another. D) The IRR method should always be used. E) It may accept as many of the five projects it wishes if they have positive NPV's. When evaluating whether to invest in a new manufacturing plant, all the following should be treated as incremental cash flows except A) Money already spent on the engineering design of the new plant. B) Lost earnings on other products due to executive time spent in the new facility. C) The initial investment in inventories of raw materials for the additional manufacturing process. D) Money to be spent demolishing an old building on the site if the project is accepted. E) Using previously purchased equipment for the new manufacturing plant, that could alternatively be rented out, but is not currently being used or rented

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts