Question: A company is considering a 3-year project with an initial cost of $876,000. The project will not directly produce any sales but will reduce operating

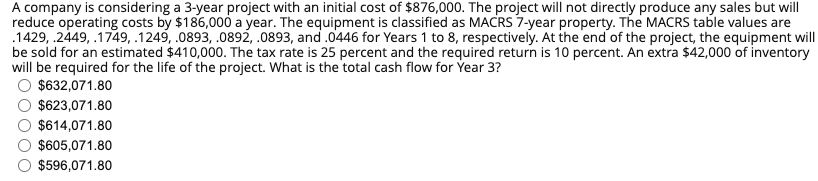

A company is considering a 3-year project with an initial cost of $876,000. The project will not directly produce any sales but will reduce operating costs by $186,000 a year. The equipment is classified as MACRS 7-year property. The MACRS table values are .1429, 2449,1749, 1249, 0893, .0892.0893, and .0446 for Years 1 to 8, respectively. At the end of the project, the equipment will be sold for an estimated $410,000. The tax rate is 25 percent and the required return is 10 percent. An extra $42,000 of inventory will be required for the life of the project. What is the total cash flow for Year 3? $632,071.80 $623,071.80 $614,071.80 $605,071.80 $596,071.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts