Question: A company is considering a lockbox system that will reduce the collection time by 2 days on average. The company can earn an APR of

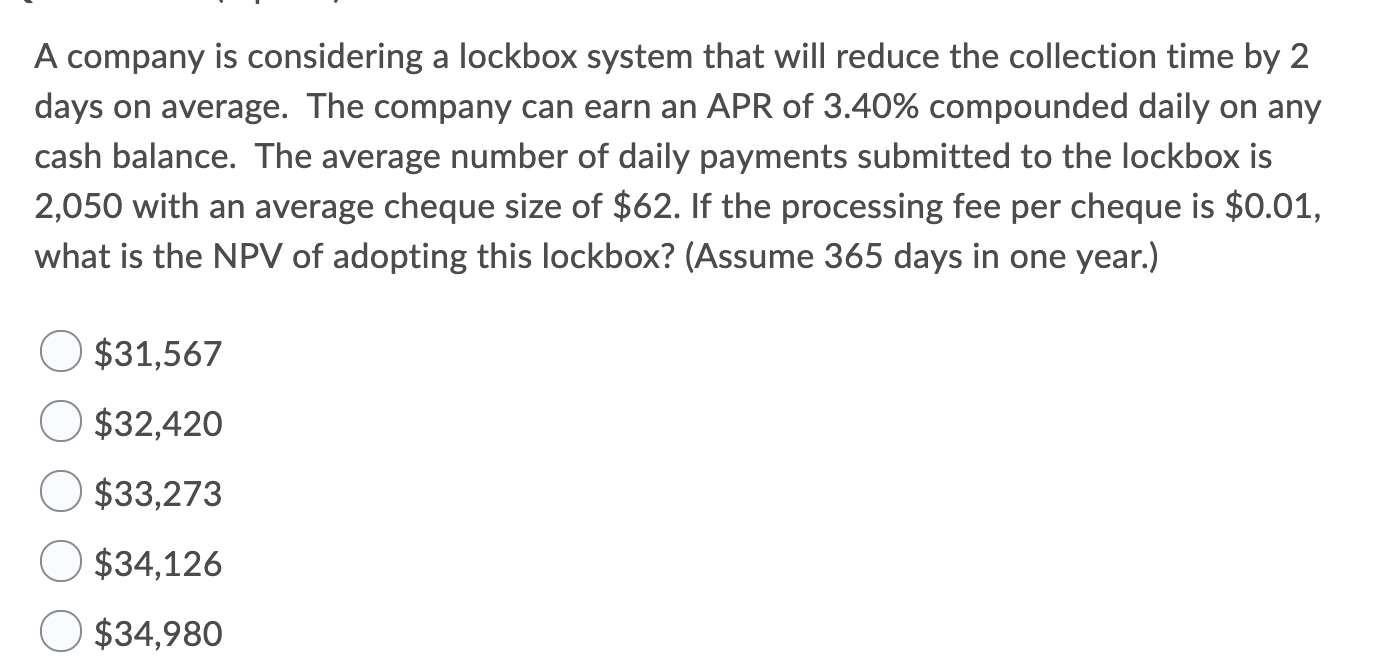

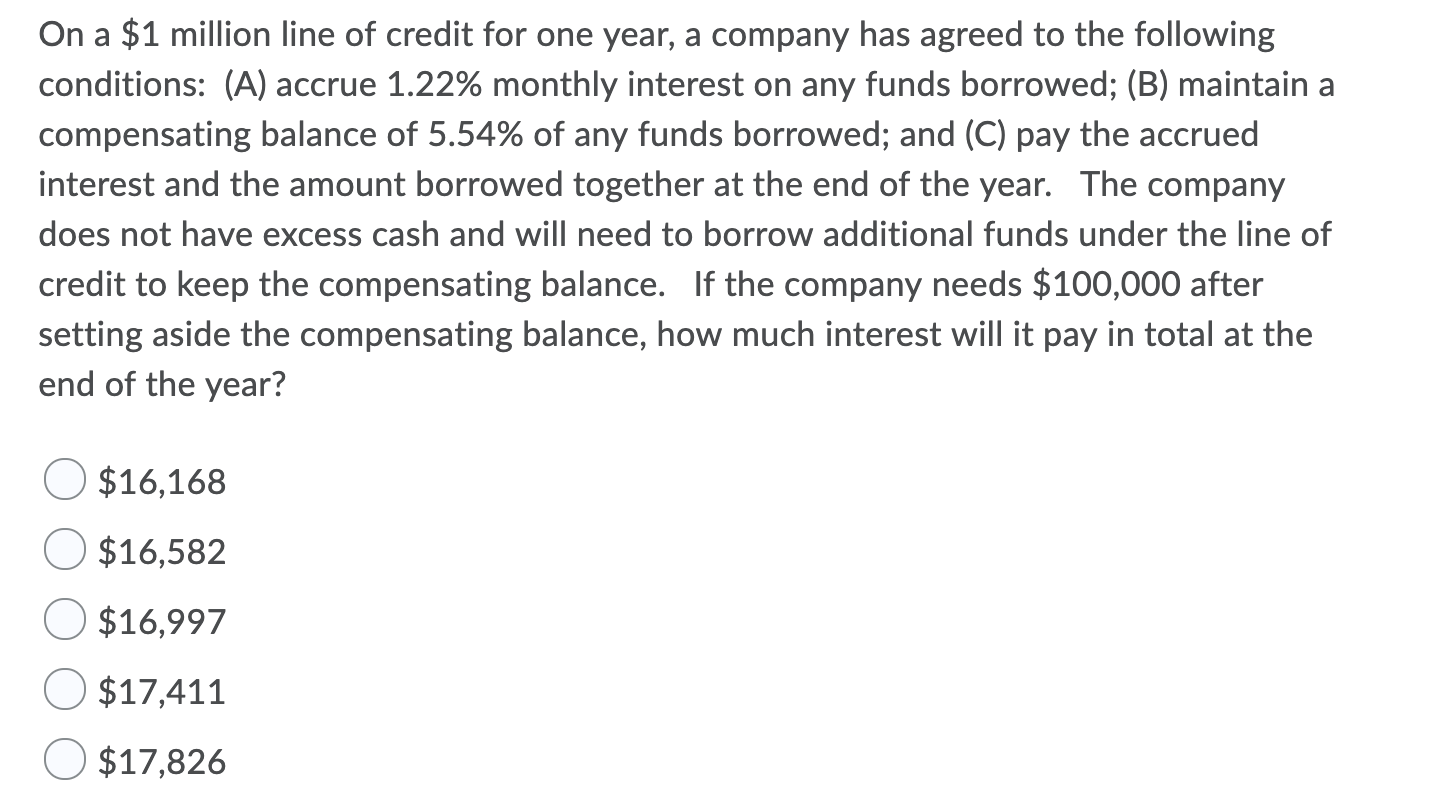

A company is considering a lockbox system that will reduce the collection time by 2 days on average. The company can earn an APR of 3.40% compounded daily on any cash balance. The average number of daily payments submitted to the lockbox is 2,050 with an average cheque size of $62. If the processing fee per cheque is $0.01, what is the NPV of adopting this lockbox? (Assume 365 days in one year.) $31,567 $32,420 $33,273 $34,126 $34,980 On a $1 million line of credit for one year, a company has agreed to the following conditions: (A) accrue 1.22% monthly interest on any funds borrowed; (B) maintain a compensating balance of 5.54% of any funds borrowed; and (C) pay the accrued interest and the amount borrowed together at the end of the year. The company does not have excess cash and will need to borrow additional funds under the line of credit to keep the compensating balance. If the company needs $100,000 after setting aside the compensating balance, how much interest will it pay in total at the end of the year? $16,168 $16,582 O $16,997 O $17,411 O $17,826

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts