Question: A company is considering a project that will last for 4 years with no residual value. The project has the following cash flows and

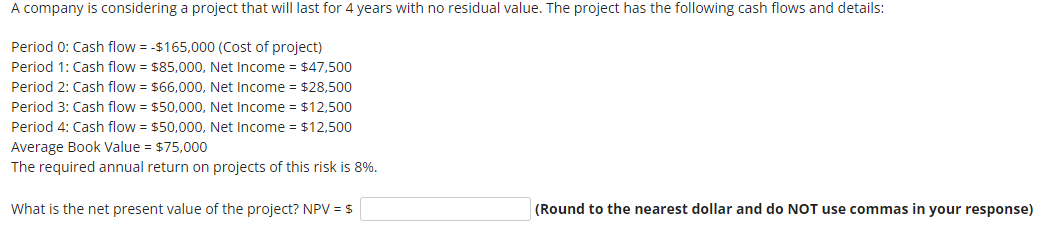

A company is considering a project that will last for 4 years with no residual value. The project has the following cash flows and details: Period 0: Cash flow = -$165,000 (Cost of project) Period 1: Cash flow = $85,000, Net Income = $47,500 Period 2: Cash flow = $66,000, Net Income = $28,500 Period 3: Cash flow = $50,000, Net Income = $12,500 Period 4: Cash flow = $50,000, Net Income = $12,500 Average Book Value = $75,000 The required annual return on projects of this risk is 8%. What is the net present value of the project? NPV = $ (Round to the nearest dollar and do NOT use commas in your response)

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

D3 fir C3B3 A C D Year Cash flow PVIF8 ... View full answer

Get step-by-step solutions from verified subject matter experts