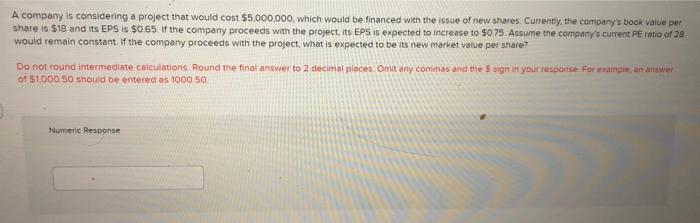

Question: A company is considering a project that would cost $5,000,000, which would be financed with the issue of new shares. Currently, the company's book value

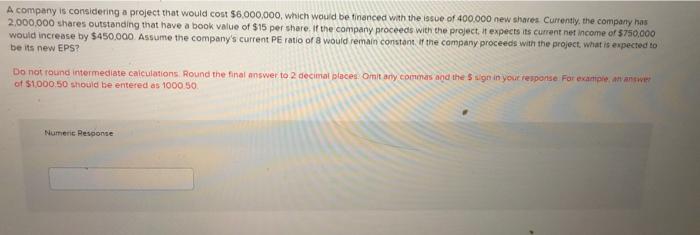

A company is considering a project that would cost $5,000,000, which would be financed with the issue of new shares. Currently, the company's book value pw share is $18 and its EPS is $065. If the company proceeds with the project, its EPS is expected to increase to $0.75 Assume the company's current PE ratio of 28 would remain constant. If the company proceeds with the project, what is expected to be its new market value per share? Do not found intermediate calculations Round the final answer to 2 decimal places Omit any commas and the sign in your response. For exampin, an answer of $1,000 50 should be entered as 1000 50 Numeric Response A company is considering a project that would cost $6,000,000, which would be financed with the issue of 400.000 new shares Currently, the company has 2,000,000 shares outstanding that have a book value of $15 per share. If the company proceeds with the project. It expects its current net income of $750,000 would increase by $450,000 Assume the company's current PE ratio of 8 would remain constant of the company proceeds with the project what is expected to be its new EPS? Do not round intermediate calculations. Round the final answer to 2 decimat places: Omit any commas and the Sign in your response. For example, anane of $1000,50 should be entered as 1000.50 Numere Response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts