Question: A company is considering four mutually exclusive projects A, B, C, and D. Project Arequires an initial investment of $100,000 and is expected to generate

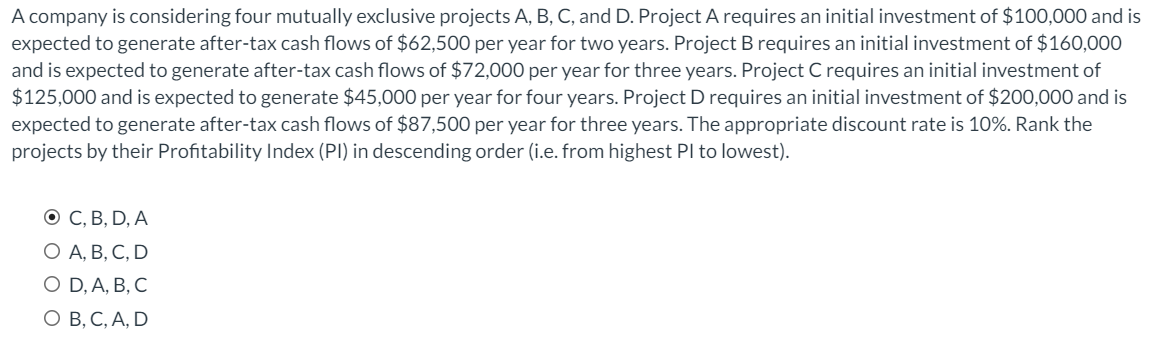

A company is considering four mutually exclusive projects A, B, C, and D. Project Arequires an initial investment of $100,000 and is expected to generate after-tax cash flows of $62,500 per year for two years. Project B requires an initial investment of $160,000 and is expected to generate after-tax cash flows of $72,000 per year for three years. Project Crequires an initial investment of $125,000 and is expected to generate $45,000 per year for four years. Project D requires an initial investment of $200,000 and is expected to generate after-tax cash flows of $87,500 per year for three years. The appropriate discount rate is 10%. Rank the projects by their Profitability Index (PI) in descending order (i.e. from highest Pl to lowest). O C, B, D, A O A, B, C, D OD, A, B, C OB, C, A, D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts