Question: A company is considering purchasing a new coffee machine for its break room. The machine would cost $54 and last for three years, before being

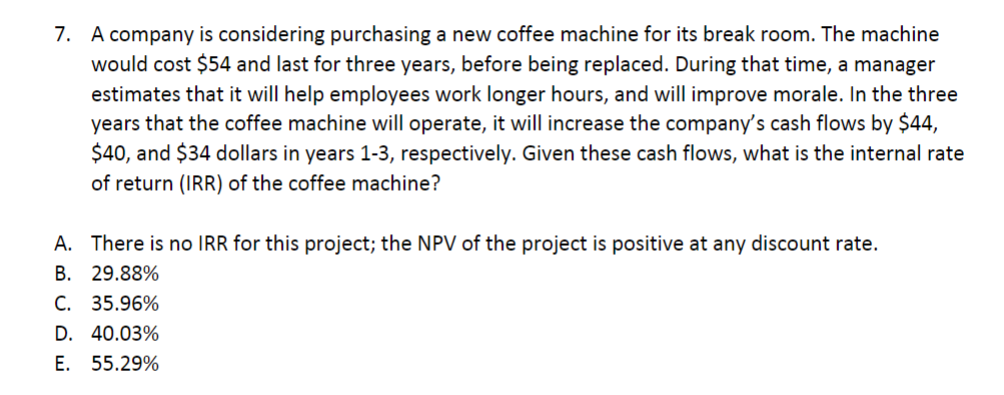

A company is considering purchasing a new coffee machine for its break room. The machine would cost $54 and last for three years, before being replaced. During that time, a manager estimates that it will help employees work longer hours, and will improve morale. In the three years that the coffee machine will operate, it will increase the companys cash flows by $44, $40, and $34 dollars in years 1-3, respectively. Given these cash flows, what is the internal rate of return (IRR) of the coffee machine? A. There is no IRR for this project; the NPV of the project is positive at any discount rate. B. 29.88% C. 35.96% D. 40.03% E. 55.29%

7. A company is considering purchasing a new coffee machine for its break room. The machine would cost $54 and last for three years, before being replaced. During that time, a manager estimates that it will help employees work longer hours, and will improve morale. In the three years that the coffee machine will operate, it will increase the company's cash flows by $44, $40, and $34 dollars in years 13, respectively. Given these cash flows, what is the internal rate of return (IRR) of the coffee machine? A. There is no IRR for this project; the NPV of the project is positive at any discount rate. B. 29.88% C. 35.96% D. 40.03% E. 55.29%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts