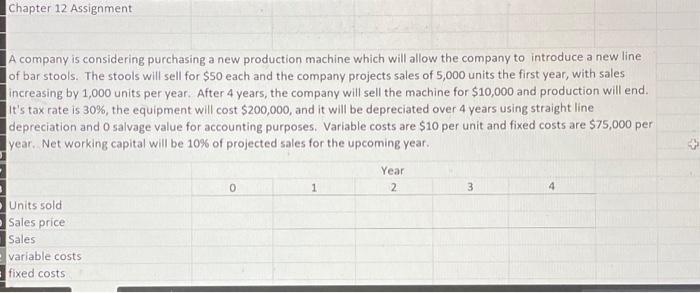

Question: A company is considering purchasing a new production machine which will allow the company to introduce a new line of bar stools. The stools will

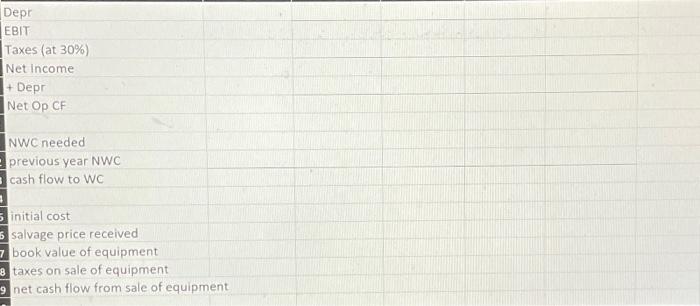

A company is considering purchasing a new production machine which will allow the company to introduce a new line of bar stools. The stools will sell for $50 each and the company projects sales of 5,000 units the first year, with sales increasing by 1,000 units per year. After 4 years, the company will sell the machine for $10,000 and production will end. It's tax rate is 30%, the equipment will cost $200,000, and it will be depreciated over 4 years using straight line depreciation and 0 salvage value for accounting purposes. Variable costs are $10 per unit and fixed costs are $75,000 per year. Net working capital will be 10% of projected sales for the upcoming year. Depr EBIT Taxes (at 30\%) Net income + Depr Net Op CF NWC needed previous year NWC cash flow to WC initial cost salvage price received book value of equipment 8 taxes on sale of equipment 9 net cash flow from sale of equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts