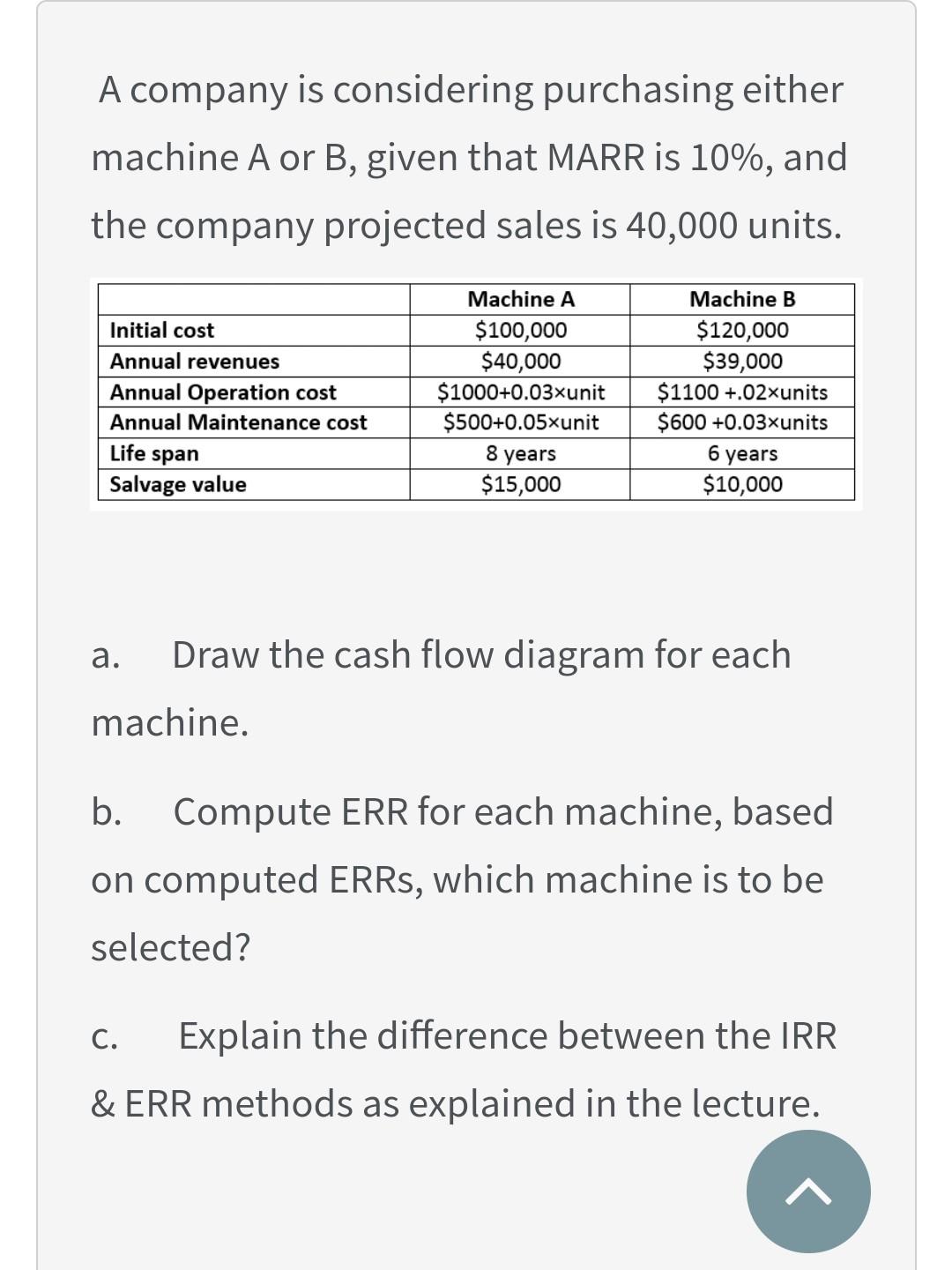

Question: A company is considering purchasing either machine A or B, given that MARR is 10%, and the company projected sales is 40,000 units. Machine A

A company is considering purchasing either machine A or B, given that MARR is 10%, and the company projected sales is 40,000 units. Machine A Machine B Initial cost Annual revenues $100,000 $40,000 $1000+0.03xunit $500+0.05xunit 8 years $15,000 $120,000 $39,000 $1100 +.02xunits $600 +0.03xunits Annual Operation cost Annual Maintenance cost Life span 6 years Salvage value $10,000 a. Draw the cash flow diagram for each machine. b. Compute ERR for each machine, based on computed ERRs, which machine is to be selected? C. Explain the difference between the IRR & ERR methods as explained in the lecture

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts