Question: A company is considering purchasing equipment that will cost $1,000,000. The equipment is classified at a CCA rate of 25%. The cquipment will add

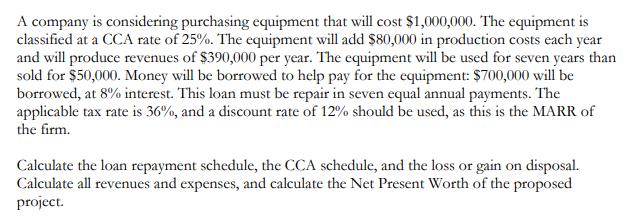

A company is considering purchasing equipment that will cost $1,000,000. The equipment is classified at a CCA rate of 25%. The cquipment will add $80,000 in production costs each year and will produce revenues of $390,000 per year. The equipment will be used for seven years than sold for $50,000. Money will be borrowed to help pay for the equipment: $700,000 will be borrowed, at 8% interest. This loan must be repair in seven equal annual payments. The applicable tax rate is 36%, and a discount rate of 12% should be used, as this is the MARR of the firm. Calculate the loan repayment schedule, the CCA schedule, and the loss or gain on disposal. Calculate all revenues and expenses, and calculate the Net Present Worth of the proposed project.

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Loan repayment schedule Year PO Beginning Principal A Installment IP8 Interest Part paid RAI Principal Part paid OPR Principal outstanding 1 70000000 ... View full answer

Get step-by-step solutions from verified subject matter experts