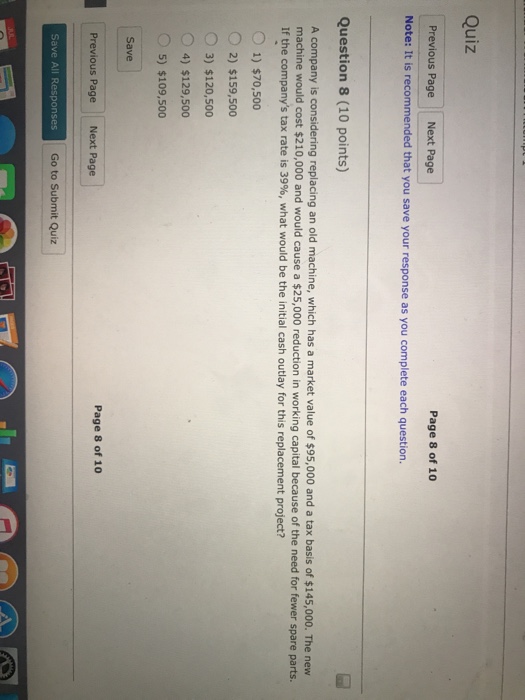

Question: A company is considering replacing an old machine, which has a market value of exist95,000 and a tax basis of exist145,000. The new machine would

A company is considering replacing an old machine, which has a market value of exist95,000 and a tax basis of exist145,000. The new machine would cost exist210,000 and would cause a exist25,000 reduction in working capital because of the need for fewer spare parts. If the company's tax rate is 39%, what would be the initial cash outlay for this replacement project? 1) exist70, 500 2) exist159, 500 3) exist120, 500 4) exist129, 500 5) exist109, 500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts