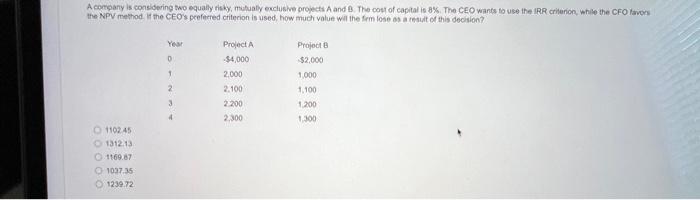

Question: A company is considering two equally risky, mutually exclusive projects A and B. The cost of capital is 8%. The CEO wants to use the

A company is considering two equally risky, mutually exclusive projects A and B. The cost of capital is 8%. The CEO wants to use the IRR criterion, while the CFO favors the NPV method. If the CEO's preferred criterion is used, how much value will the firm lose as a result of this decision? O 1102.45 O1312.13 O1169.87 1037.35 1239.72 Year OT 234 0 1 Project A -$4,000 2,000 2,100 2,200 2,300 Project B -$2,000 1,000 1,100 1,200 1,300

A company is considering two equally risky, motuaby excluske grojects A and B. The cost of capital is 8\%. The CEO wants to use the IRR criterion, white the CFO lavon the NPV method. it the CEOs preferted criterion is used, how much value will the Arin lose as a resilt of this decilon? 110245 1312.13 1469.67 1037.35 1239.72

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock