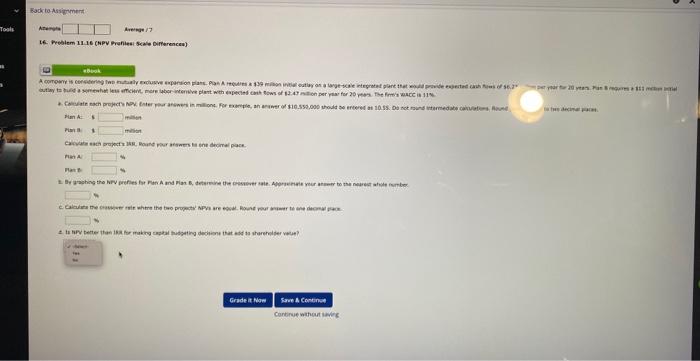

Question: A company is considering two mutually exclusive expansion plans. Plan A requires a $39 million initial outlay on a large-scale integ expected cash flows of

A company is considering two mutually exclusive expansion plans. Plan A requires a $39 million initial outlay on a large-scale integ expected cash flows of $6.23 million per year for 20 years. Plan B requires a $11 million initial outlay to build a somewhat less effici with expected cash flows of $2.47 million per year for 20 years. The firm's WACC is 11%.

that would provide labor-intensive plant

a. Calculate each project's NV. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places. Plan A: _____$ million

Plan B:________$million

Calculate each project's IRR. Round your answers to one decimal place.

Plan A:_____%

Plan B:______%

- By graphing the NPV profiles for Plan A and Plan B, determine the crossover rate. Approximate your answer to the nearest whole number. ______%

- Calculate the crossover rate where the two proiects' NPVs are equal. Round your answer to one decimal place. ______%

- Is NPV better than IRR for making capital budgeting decisions that add to shareholder value? Yes or No?

ManA= finta tanx Bate 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts