Question: A company is evaluating three projects, A, B, and C. This company uses four evaluation criteria: Operational feasibility: Fulfilling the customer requirements. Its weight in

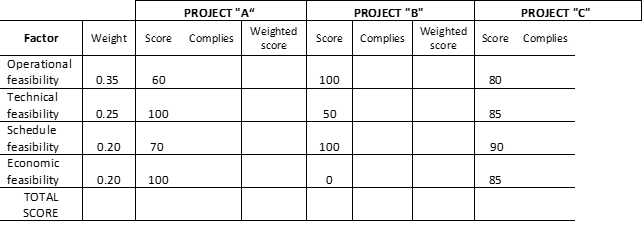

A company is evaluating three projects, A, B, and C. This company uses four evaluation criteria:

Operational feasibility: Fulfilling the customer requirements. Its weight in the decision is 35%,

Technical feasibility: Having the technical expertise to design and build this solution; and how practical the solution is from a technical perspective. Its weight in the decision is 25%

Schedule feasibility: The alternative can be implemented within an acceptable time period. Its weight in the decision is 20%

Economic feasibility: represented by the Net Present Value. Its weight in the decision is 20%

The company uses a 0 to 100 scoring system. Scores for each project/criteria combination are shown in the table below. Economic feasibility is a hard constraint (if a projects budget is above the limit, the project is eliminated from consideration). The budget of Project B goes above the limit.

Using the Checklist Model (unweighted factor scoring model), what project do you recommend?

Using a Constrained Multi-weighted Scoring Model what project do you recommend? Show all your work/calculations.

The economic feasibility was calculated using the Net Present Value. The net cash flows (in thousand) of each project are presented below. Calculate the NPV of each project. Rank the projects using only the NPV as criterion. Use a 12% discount rate.

| Year | Project A | Project B | Project C |

| 0 | (2,000) | (4,000) | (2,150) |

| 1 | 500 | 600 | 750 |

| 2 | 800 | 900 | 850 |

| 3 | 1,200 | 1,000 | 1,000 |

| 4 | 1,500 | 1,600 | 1,300 |

| 5 | 1,500 | 1,600 | 1,300 |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts