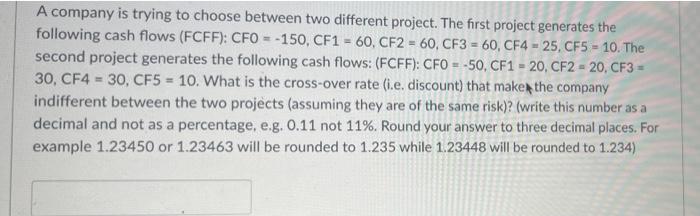

Question: A company is trying to choose between two different project. The first project generates the following cash flows (FCFF): CFO = -150, CF1 = 60,

A company is trying to choose between two different project. The first project generates the following cash flows (FCFF): CFO = -150, CF1 = 60, CF2 = 60, CF3 = 60, CF4 - 25, CF5 = 10. The second project generates the following cash flows: (FCFF): CFO = -50, CF1 = 20, CF2 - 20, CF3 = 30, CF4 - 30, CF5 = 10. What is the cross-over rate (i.e. discount) that make the company indifferent between the two projects (assuming they are of the same risk)? (write this number as a decimal and not as a percentage, e.g. 0.11 not 11%. Round your answer to three decimal places. For example 1.23450 or 1.23463 will be rounded to 1.235 while 1.23448 will be rounded to 1.234)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts