Question: A company is trying to determine if prototyping is worthwhile on one of its new products they plan to launch. They have come up with

A company is trying to determine if prototyping is worthwhile on one of its new products they plan to launch. They have come up with the following loss impact of whether the newlylaunched product works or fails.

If they invest a setup cost of $ in prototyping to test the product before launching and the newlylaunched product fails, then there will be a monetary loss impact on them of $based on chances of failure in addition to the initial setup investment, but if the product succeeds based on chances of success then their only monetary loss impact is the prototype setup cost.

If they choose not to invest in prototyping and launches the product as is then there will be a monetary loss impact on them of $based on chances of failure but if the product succeeds based on chances of success then their monetary loss impact is zero.

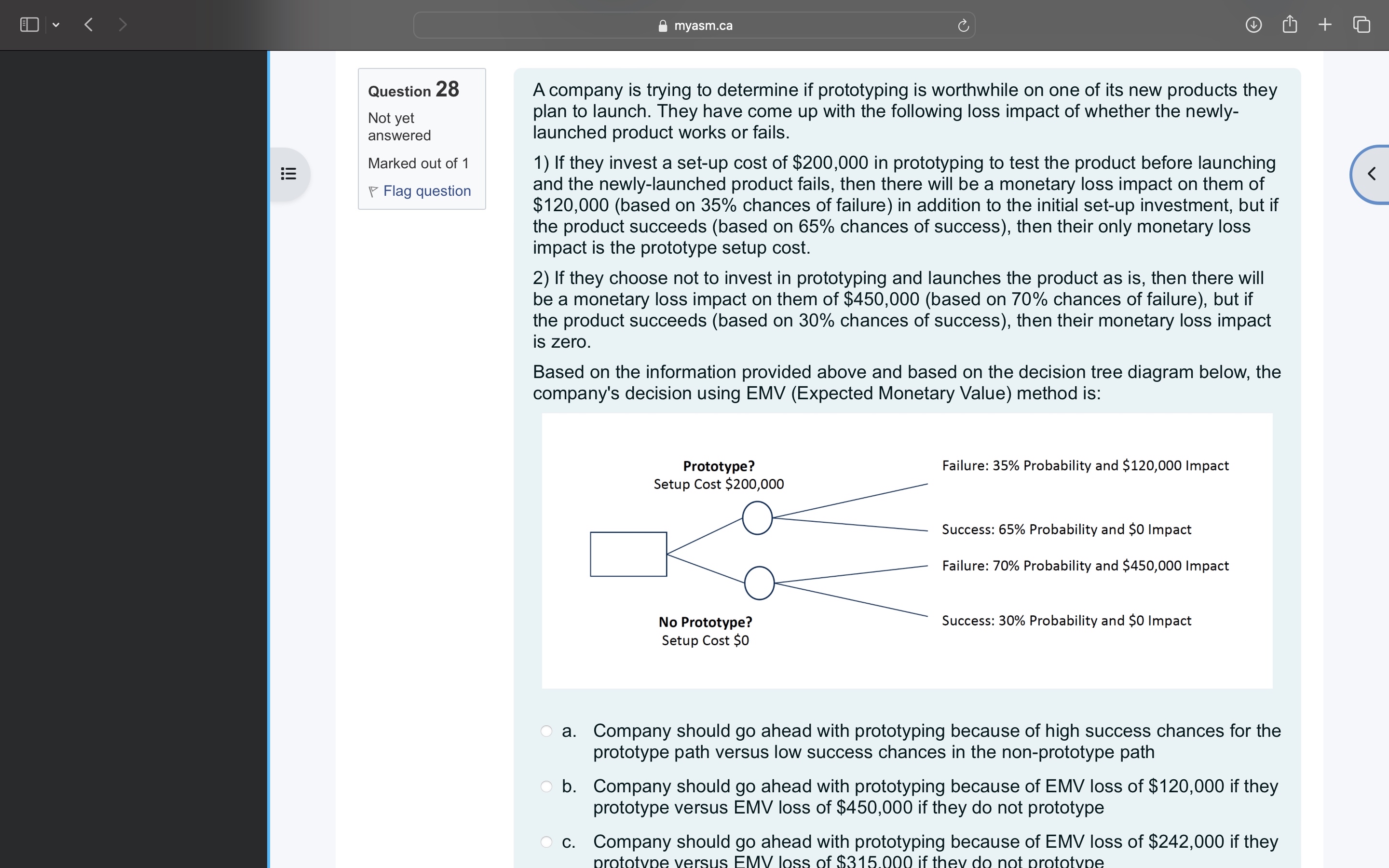

Based on the information provided above and based on the decision tree diagram below, the company's decision using EMV Expected Monetary Value method is:

a Company should go ahead with prototyping because of high success chances for the prototype path versus low success chances in the nonprototype path

b Company should go ahead with prototyping because of EMV loss of $ if they prototype versus EMV loss of $ if they do not prototype

c Company should go ahead with prototyping because of EMV loss of $ if they

c Company should go ahead with prototyping because of EMV loss of $ if theyd. Company should not go ahead with prototyping as they can save the $ prototype setup cost

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock