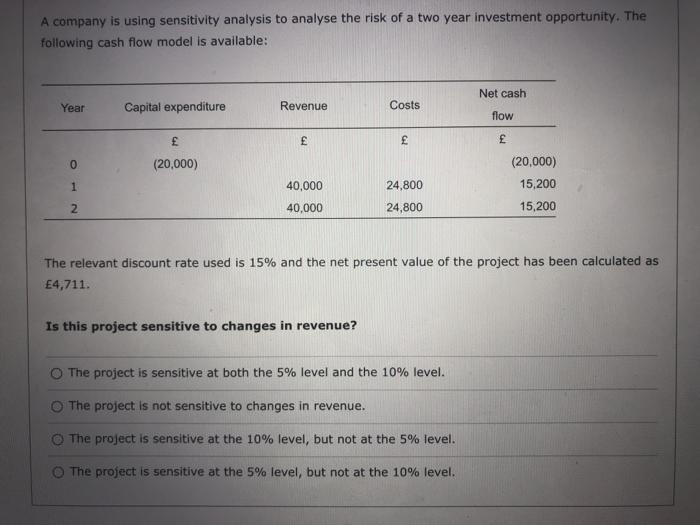

Question: A company is using sensitivity analysis to analyse the risk of a two year investment opportunity. The following cash flow model is available: Net cash

A company is using sensitivity analysis to analyse the risk of a two year investment opportunity. The following cash flow model is available: Net cash Year Capital expenditure Revenue Costs flow E 0 (20,000) 1 24,800 40,000 40,000 (20,000) 15,200 15,200 2 24,800 The relevant discount rate used is 15% and the net present value of the project has been calculated as 4,711. Is this project sensitive to changes in revenue? The project is sensitive at both the 5% level and the 10% level. The project is not sensitive to changes in revenue. The project is sensitive at the 10% level, but not at the 5% level. The project is sensitive at the 5% level, but not at the 10% level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts