Question: A company manufactures three products using the same production process. The costs incurred up to the split-off point are $200,000. These costs are allocated to

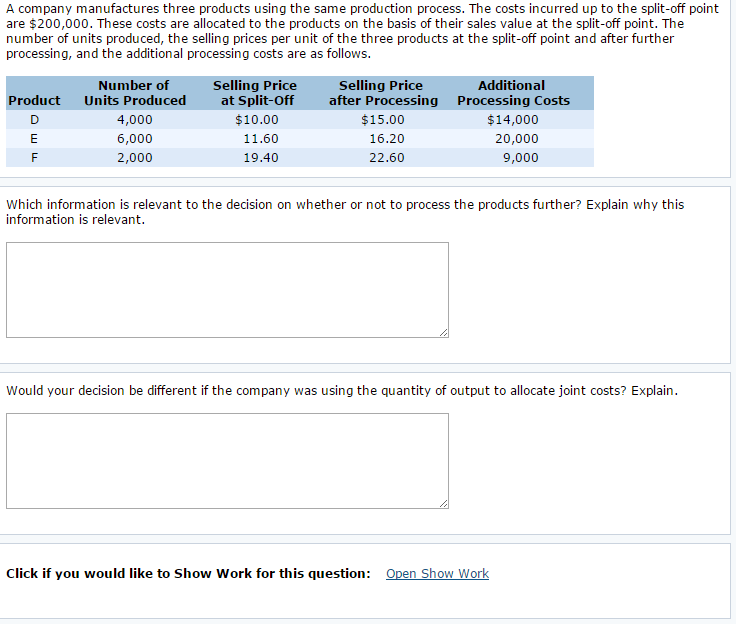

A company manufactures three products using the same production process. The costs incurred up to the split-off point are $200,000. These costs are allocated to the products on the basis of their sales value at the split-off point. The number of units produced, the selling prices per unit of the three products at the split-off point and after further processing, and the additional processing costs are as follows.

(answer in essay form)

A company manufactures three products using the same production process. The costs incurred up to the split-off point are $200,000. These costs are allocated to the products on the basis of their sales value at the split-off point. The number of units produced, the selling prices per unit of the three products at the split-off point and after further processing, and the additional processing costs are as follows Selling Price at Split-Off $10.00 11.60 19.40 Selling Price after Processing $15.00 16.20 22.60 Additional Processing Costs $14,000 20,000 Number of Product Units Produced 4,000 6,000 2,000 9,000 Which information is relevant to the decision on whether or not to process the products further? Explain why this information is relevant Would your decision be different if the company was using the quantity of output to allocate joint costs? Explain Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts