Question: A company needs to chosse between 2 plant options. Evaluate both plant op1 and opt 2 with respect to (a) Payback Time [5 marks] (b)

A company needs to chosse between 2 plant options. Evaluate both plant op1 and opt 2 with respect to

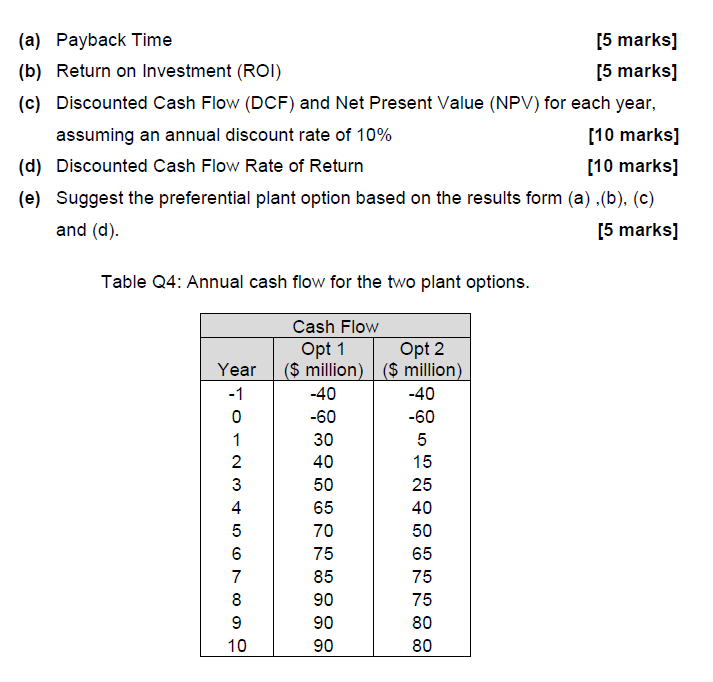

(a) Payback Time [5 marks] (b) Return on Investment (ROI) [5 marks] (c) Discounted Cash Flow (DCF) and Net Present Value (NPV) for each year, assuming an annual discount rate of 10% [10 marks] (d) Discounted Cash Flow Rate of Return [10 marks] (e) Suggest the preferential plant option based on the results form (a) (b), (c) and (d). [5 marks] Table Q4: Annual cash flow for the two plant options. Year -1 0 1 2 3 4 5 6 7 8 9 Cash Flow Opt 1 Opt 2 ($ million) ($ million) -40 -40 -60 -60 30 5 40 15 50 25 65 40 70 50 75 65 85 75 90 90 80 90 80 75 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts