Question: A company pays ( $ 8 4 3 , 6 0 0 ) cash to acquire an iron mine on January 1

A company pays $ cash to acquire an iron mine on January At that same time, it incurs additional costs of $ cash to access the mine, which is estimated to hold tons of iron. The estimated value of the land after the iron is removed is $ Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

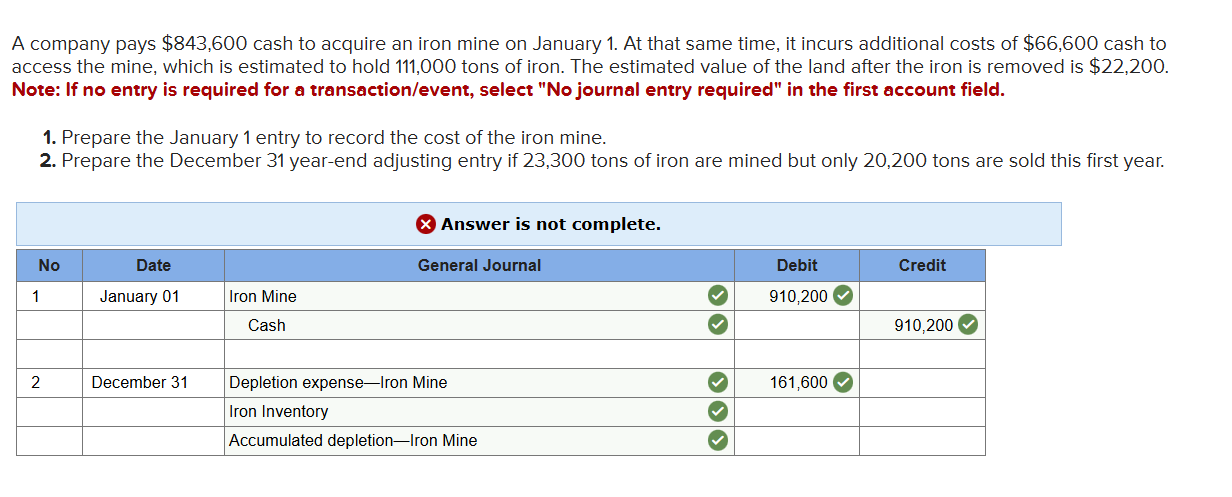

Prepare the January entry to record the cost of the iron mine.

Prepare the December yearend adjusting entry if tons of iron are mined but only tons are sold this first year. A company pays $ cash to acquire an iron mine on January At that same time, it incurs additional costs of $ cash to access the mine, which is estimated to hold tons of iron. The estimated value of the land after the iron is removed is $ Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Prepare the January entry to record the cost of the iron mine.

Prepare the December yearend adjusting entry if tons of iron are mined but only tons are sold this first year.

Answer is not complete.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock