Question: A company preparing for a Chapter 7 liquidation has listed the following liabilities: Note payable A of $104,000 secured by land having a book

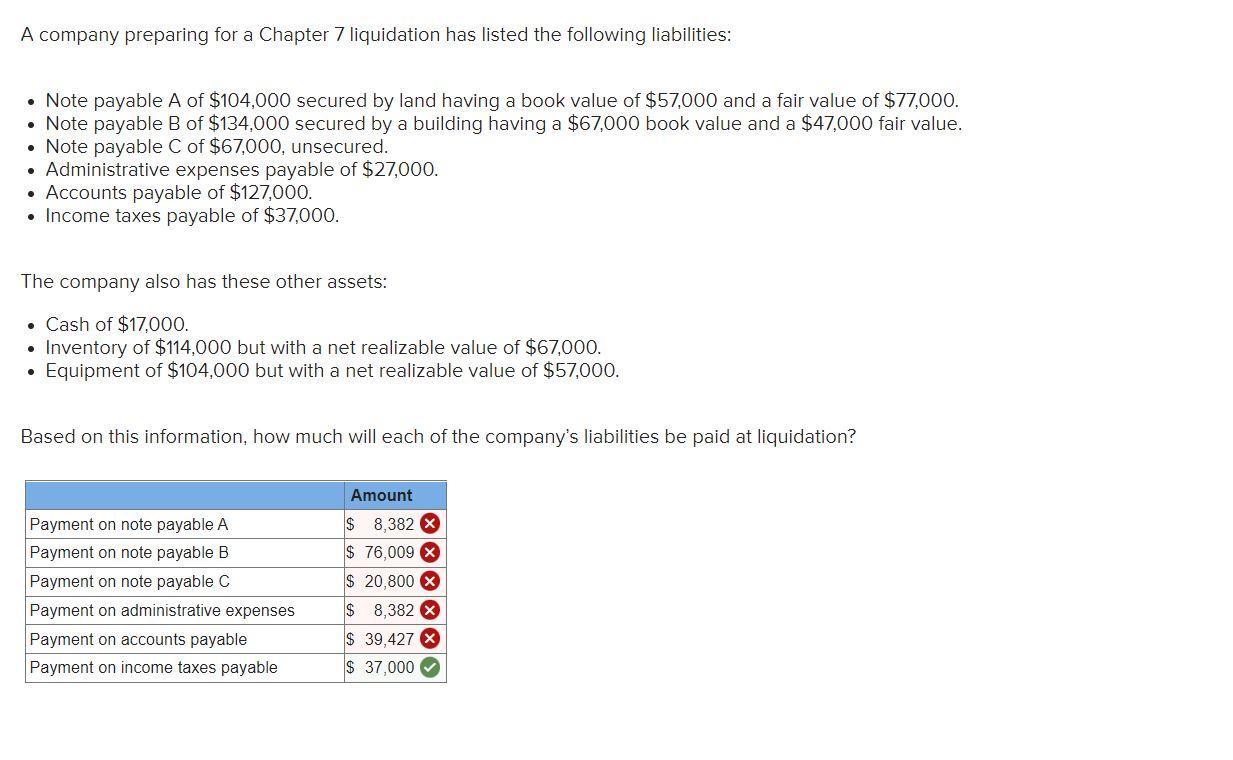

A company preparing for a Chapter 7 liquidation has listed the following liabilities: Note payable A of $104,000 secured by land having a book value of $57,000 and a fair value of $77,000. Note payable B of $134,000 secured by a building having a $67,000 book value and a $47,000 fair value. Note payable C of $67,000, unsecured. Administrative expenses payable of $27,000. Accounts payable of $127,000. Income taxes payable of $37,000. The company also has these other assets: Cash of $17,000. Inventory of $114,000 but with a net realizable value of $67,000. Equipment of $104,000 but with a net realizable value of $57,000. Based on this information, how much will each of the company's liabilities be paid at liquidation? Amount Payment on note payable A $ 8,382 X Payment on note payable B $ 76,009 X Payment on note payable C $ 20,800 X $ 8,382 X $ 39,427 X $ 37,000 O Payment on administrative expenses Payment on accounts payable Payment on income taxes payable

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Free Assets Fair Market Value Cash 17000 Inventory 67000 Equipment 57000 Total A 141000 Liabilities ... View full answer

Get step-by-step solutions from verified subject matter experts