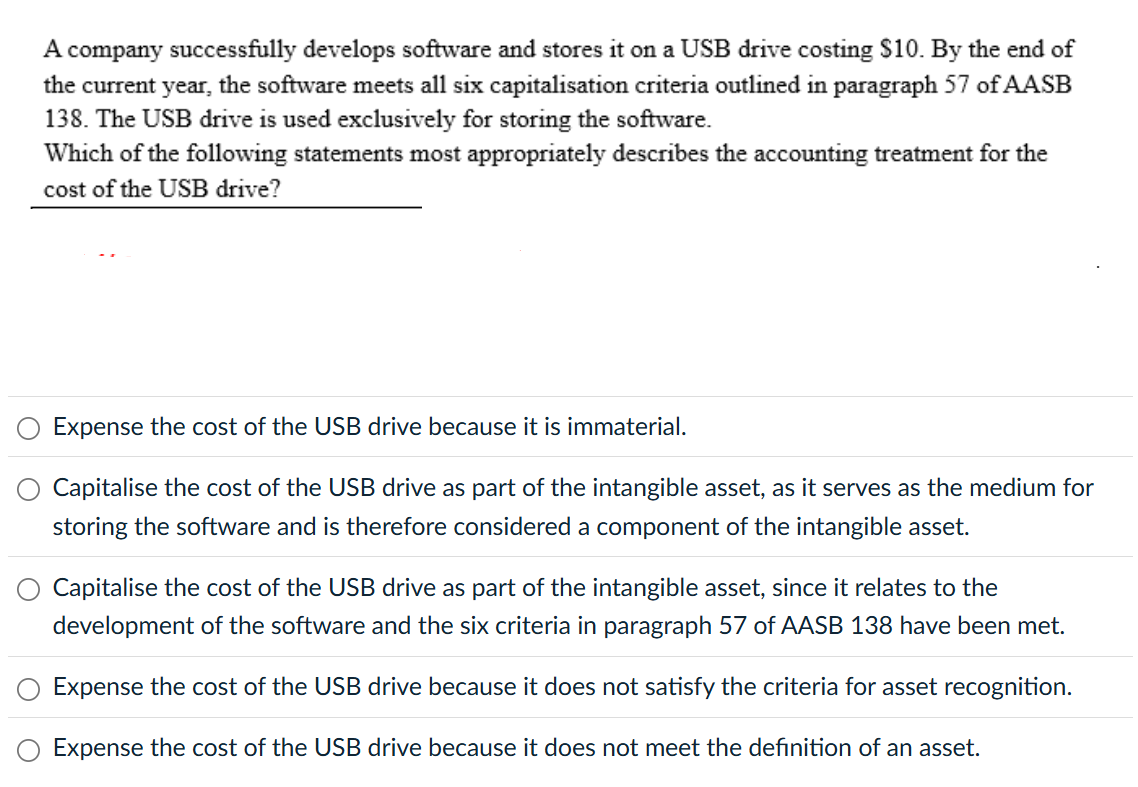

Question: A company successfully develops software and stores it on a USB drive costing ( $ 1 0 ) . By the end

A company successfully develops software and stores it on a USB drive costing $ By the end of the current year, the software meets all six capitalisation criteria outlined in paragraph of AASB The USB drive is used exclusively for storing the software.

Which of the following statements most appropriately describes the accounting treatment for the cost of the USB drive?

Expense the cost of the USB drive because it is immaterial.

Capitalise the cost of the USB drive as part of the intangible asset, as it serves as the medium for storing the software and is therefore considered a component of the intangible asset.

Capitalise the cost of the USB drive as part of the intangible asset, since it relates to the development of the software and the six criteria in paragraph of AASB have been met.

Expense the cost of the USB drive because it does not satisfy the criteria for asset recognition.

Expense the cost of the USB drive because it does not meet the definition of an asset.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock