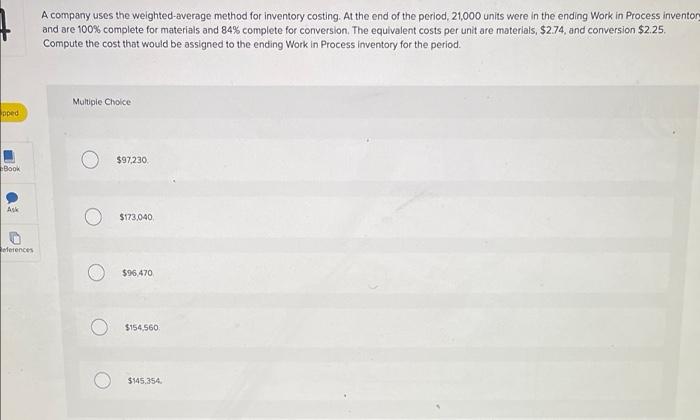

Question: A company uses the weighted-average method for inventory costing. At the end of the period, 21,000 units were in the ending Work in Process inventor

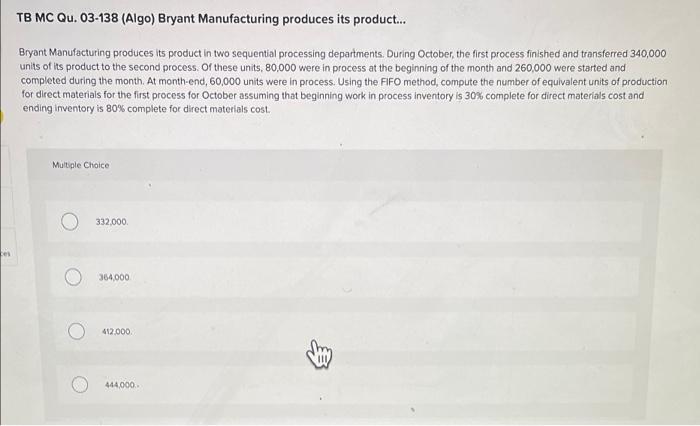

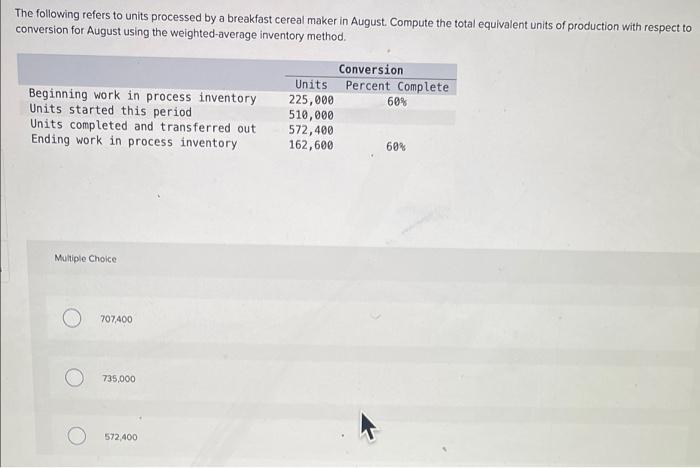

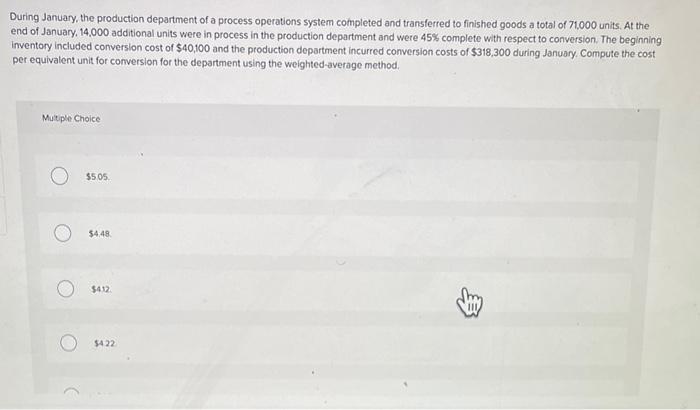

A company uses the weighted-average method for inventory costing. At the end of the period, 21,000 units were in the ending Work in Process inventor and are 100% complete for materials and 84% complete for conversion. The equivalent costs per unit are materials, $2.74, and conversion $2.25 Compute the cost that would be assigned to the ending Work in Process inventory for the period. Multiple Choice pped $97,230 EBook Ask $173,040 ferences $96 470 $154,560 $145.354 TB MC Qu. 03-138 (Algo) Bryant Manufacturing produces its product... Bryant Manufacturing produces its product in two sequential processing departments. During October, the first process finished and transferred 340,000 units of its product to the second process. Of these units, 80,000 were in process at the beginning of the month and 260,000 were started and completed during the month. At month-end, 60,000 units were in process. Using the FIFO method, compute the number of equivalent units of production for direct materials for the first process for October assuming that beginning work in process inventory is 30% complete for direct materials cost and ending inventory is 80% complete for direct materials cost. Multiple Choice 332,000 Les 364.000 412.000 444000 The following refers to units processed by a breakfast cereal maker in August Compute the total equivalent units of production with respect to conversion for August using the weighted average inventory method Beginning work in process inventory Units started this period Units completed and transferred out Ending work in process inventory Conversion Units Percent Complete 225,000 60% 510,000 572,400 162,600 60% Multiple Choice 707400 735,000 572 400 During January, the production department of a process operations system completed and transferred to finished goods a total of 71000 units. At the end of January 14.000 additional units were in process in the production department and were 45% complete with respect to conversion. The beginning Inventory included conversion cost of $40,100 and the production department incurred conversion costs of $318,300 during January, Compute the cost per equivalent unit for conversion for the department using the weighted average method. Multiple Choice $505 $448 $412 $422

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts