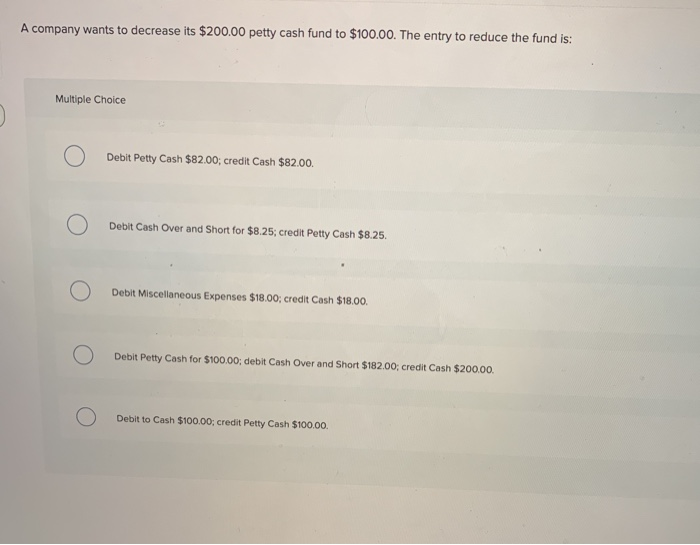

Question: A company wants to decrease its $200.00 petty cash fund to $100.00. The entry to reduce the fund is: Multiple Choice Debit Petty Cash $82.00;

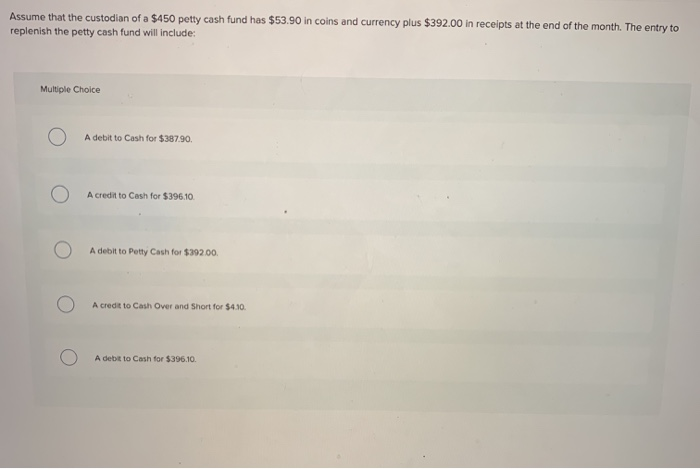

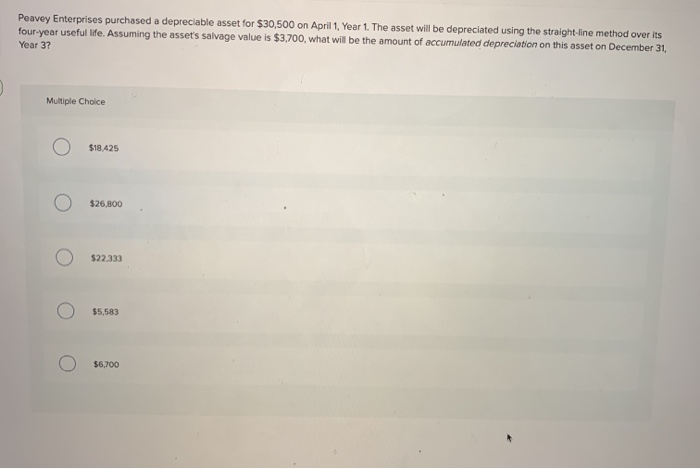

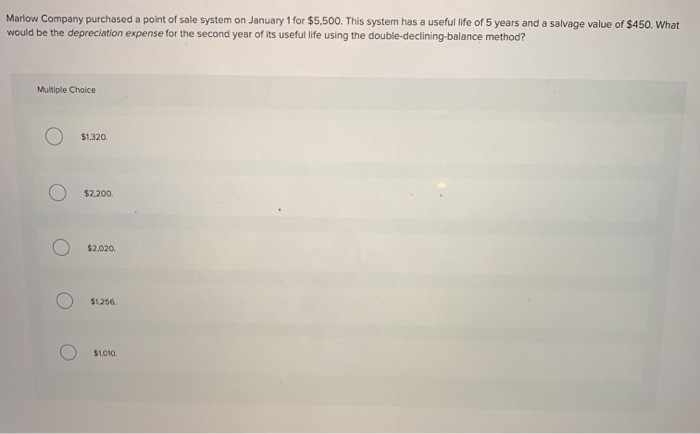

A company wants to decrease its $200.00 petty cash fund to $100.00. The entry to reduce the fund is: Multiple Choice Debit Petty Cash $82.00; credit Cash $82.00. Debit Cash Over and Short for $8.25; credit Petty Cash $8.25. Debit Miscellaneous Expenses $18.00, credit Cash $18.00, Debit Petty Cash for $100.00; debit Cash Over and Short $182.00; credit Cash $200.00. Debit to Cash $100.00; credit Petty Cash $100.00 Assume that the custodian of a $450 petty cash fund has $53.90 in coins and currency plus $392.00 in receipts at the end of the month. The entry to replenish the petty cash fund will include: Multiple Choice A debit to Cash for $387.90 O O A credit to Cash for $396.10 o A debit to Potty Cash for $392.00 o 0 A credit to Cash Over and short for $4.10. o Adebt to Cash for $396.10. o Peavey Enterprises purchased a depreciable asset for $30,500 on April 1, Year 1. The asset will be depreciated using the straight-line method over its four year useful life. Assuming the asset's salvage value is $3,700, what will be the amount of accumulated depreciation on this asset on December 31, Year 3? Multiple Choice Marlow Company purchased a point of sale system on January 1 for $5,500. This system has a useful life of 5 years and a salvage value of $450. What would be the depreciation expense for the second year of its useful life using the double-declining-balance method? Multiple Choice $1.320. $2200. $2,020. $1.256. 51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts