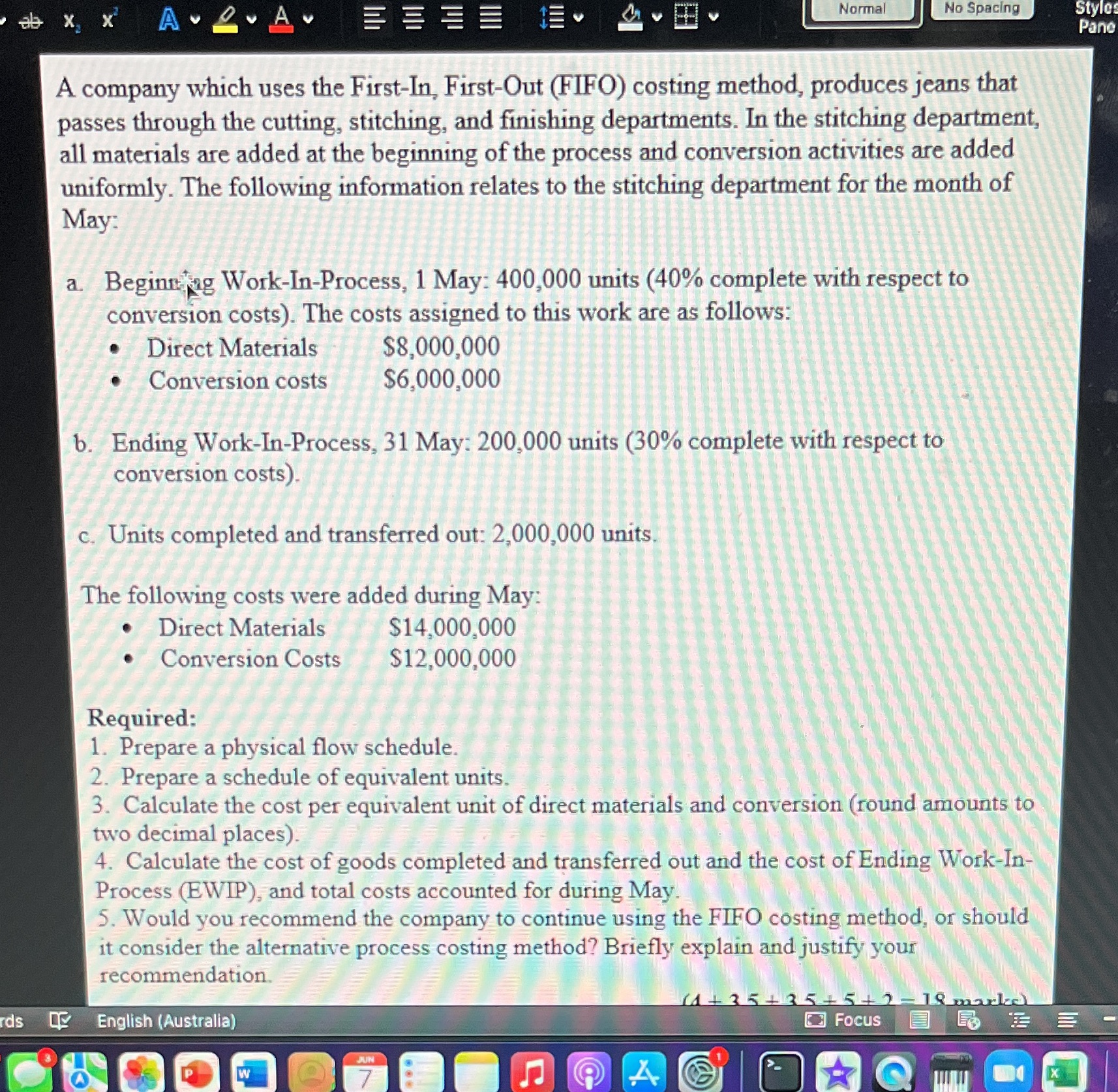

Question: A company which uses the First-In, FirstOut (FIFO) costing method, produces jeans that passes through the cutting, stitching, and nishing departments. In the stitching department,

A company which uses the First-In, FirstOut (FIFO) costing method, produces jeans that passes through the cutting, stitching, and nishing departments. In the stitching department, all materials are added at the beginning of we process and conversion activities are added uniformly. The following information relates to the stitching depmtment for the month of May: a Beginnigg Work-InProcess, 1 May: 400,000 units (40% cotnplete with respect to conversion costs). The costs assigned to this work are as follows: 0 Direct Materials $8,000,000 to Conversion costs $6,000,000 b. Ending Work-In-Process, 31 May: 200,000 units (30% complete with respect to conversion costs)- c. Units completed and transferred out: 2,000,000 units- The following costs were added dining May: 0 Direct Materials $14,000,000 0 Conversion Costs $12,000,000 Required: 1. Prepare a physical ow schedule. 2. Prepare a schedule of equivalent units. 3. Calculate the cost per equivalent unit of direct materials and consersion, (round. amounts to two decimal places). 4. Calculate the cost of goods completed and transferred out and the Cost of Ending Workin Process (EW'IP), and total costs accounted for during May, 5. Would you recommend the company to continue using the FIFO costing method, or should it consider the alternative process costing method? Briey explain a-nd justiY your recommendation ' J_

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts