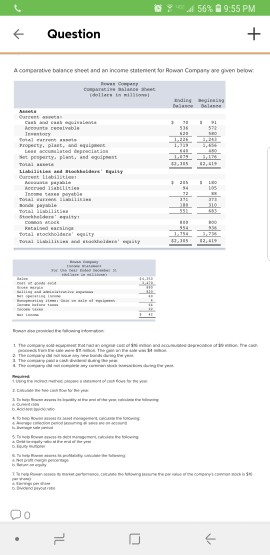

Question: A comparative balance sheet and an income statement for Rowan Company are given below: Rowan Company Comparative Balance Sheet (dollars in millions) Ending Balance Beginning

A comparative balance sheet and an income statement for Rowan Company are given below:

| Rowan Company Comparative Balance Sheet (dollars in millions) | ||||||

| Ending Balance | Beginning Balance | |||||

| Assets | ||||||

| Current assets: | ||||||

| Cash and cash equivalents | $ | 70 | $ | 91 | ||

| Accounts receivable | 536 | 572 | ||||

| Inventory | 620 | 580 | ||||

| Total current assets | 1,226 | 1,243 | ||||

| Property, plant, and equipment | 1,719 | 1,656 | ||||

| Less accumulated depreciation | 640 | 480 | ||||

| Net property, plant, and equipment | 1,079 | 1,176 | ||||

| Total assets | $ | 2,305 | $ | 2,419 | ||

| Liabilities and Stockholders' Equity | ||||||

| Current liabilities: | ||||||

| Accounts payable | $ | 205 | $ | 180 | ||

| Accrued liabilities | 94 | 105 | ||||

| Income taxes payable | 72 | 88 | ||||

| Total current liabilities | 371 | 373 | ||||

| Bonds payable | 180 | 310 | ||||

| Total liabilities | 551 | 683 | ||||

| Stockholders' equity: | ||||||

| Common stock | 800 | 800 | ||||

| Retained earnings | 954 | 936 | ||||

| Total stockholders' equity | 1,754 | 1,736 | ||||

| Total liabilities and stockholders' equity | $ | 2,305 | $ | 2,419 | ||

| Rowan Company Income Statement For the Year Ended December 31 (dollars in millions) | |||

| Sales | $ | 4,350 | |

| Cost of goods sold | 3,470 | ||

| Gross margin | 880 | ||

| Selling and administrative expenses | 820 | ||

| Net operating income | 60 | ||

| Nonoperating items: Gain on sale of equipment | 4 | ||

| Income before taxes | 64 | ||

| Income taxes | 22 | ||

| Net income | $ | 42 | |

Rowan also provided the following information:

The company sold equipment that had an original cost of $16 million and accumulated depreciation of $9 million. The cash proceeds from the sale were $11 million. The gain on the sale was $4 million.

The company did not issue any new bonds during the year.

The company paid a cash dividend during the year.

The company did not complete any common stock transactions during the year.

Required:

1. Using the indirect method, prepare a statement of cash flows for the year.

2. Calculate the free cash flow for the year.

3. To help Rowan assess its liquidity at the end of the year, calculate the following:

a. Current ratio

b. Acid-test (quick) ratio

4. To help Rowan assess its asset management, calculate the following:

a. Average collection period (assuming all sales are on account)

b. Average sale period

5. To help Rowan assess its debt management, calculate the following:

a. Debt-to-equity ratio at the end of the year

b. Equity multiplier

6. To help Rowan assess its profitability, calculate the following:

a. Net profit margin percentage

b. Return on equity

7. To help Rowan assess its market performance, calculate the following (assume the par value of the companys common stock is $10 per share):

a. Earnings per share

b. Dividend payout ratio

Transcribed image text

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts