Question: A comparative balance sheet for Halpern Corporation is presented below: Assets Accumulated depreciation Total assets Liabilities and Stockholder's Equity Accounts payable Bonds payable Common stock

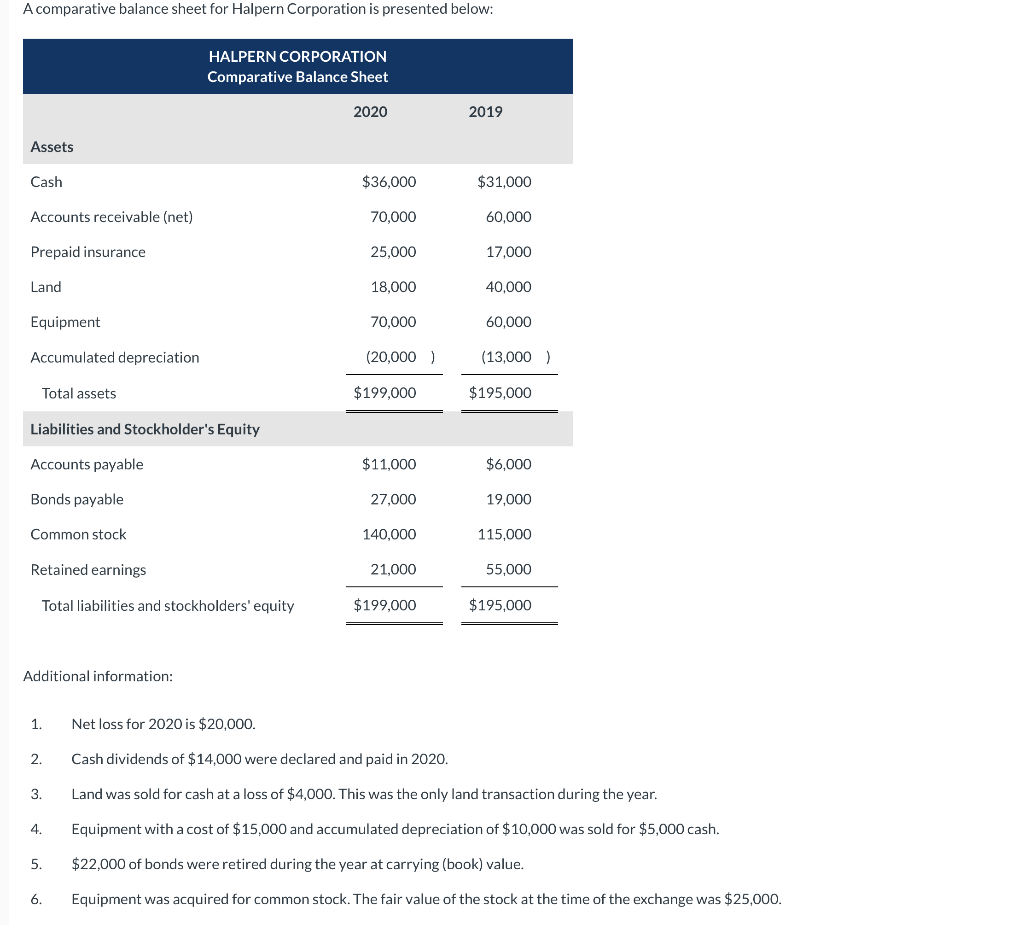

A comparative balance sheet for Halpern Corporation is presented below: Assets Accumulated depreciation Total assets Liabilities and Stockholder's Equity Accounts payable Bonds payable Common stock Retained earnings (20,000 $199,000 $11,000 27,000 140,000 21,000 ) HALPERN CORPORATION Comparative Balance Sheet 2020 2019 $31,000 60,000 17,000 40,000 60,000 (13,000 ) $195,000 $6,000 19,000 115,000 55,000 Cash $36,000 Accounts receivable (net) 70,000 Prepaid insurance 25,000 Land 18,000 Equipment 70,000 Total liabilities and stockholders' equity $199,000 $195,000 Additional information: Net loss for 2020 is $20,000. Cash dividends of $14,000 were declared and paid in 2020. Land was sold for cash at a loss of $4,000. This was the only land transaction during the year. Equipment with a cost of $15,000 and accumulated depreciation of $10,000 was sold for $5,000 cash. $22,000 of bonds were retired during the year at carrying (book) value. Equipment was acquired for common stock. The fair value of the stock at the time of the exchange was $25,000. Prepare a statement of cash flows for the year ended 2020, using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)

A comparative balance sheet for Halpern Corporation is presented below: Assets Accumulated depreciation Total assets Liabilities and Stockholder's Equity Accounts payable Bonds payable Common stock Retained earnings (20,000 $199,000 $11,000 27,000 140,000 21,000 ) HALPERN CORPORATION Comparative Balance Sheet 2020 2019 $31,000 60,000 17,000 40,000 60,000 (13,000 ) $195,000 $6,000 19,000 115,000 55,000 Cash $36,000 Accounts receivable (net) 70,000 Prepaid insurance 25,000 Land 18,000 Equipment 70,000 Total liabilities and stockholders' equity $199,000 $195,000 Additional information: Net loss for 2020 is $20,000. Cash dividends of $14,000 were declared and paid in 2020. Land was sold for cash at a loss of $4,000. This was the only land transaction during the year. Equipment with a cost of $15,000 and accumulated depreciation of $10,000 was sold for $5,000 cash. $22,000 of bonds were retired during the year at carrying (book) value. Equipment was acquired for common stock. The fair value of the stock at the time of the exchange was $25,000. Prepare a statement of cash flows for the year ended 2020, using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)

A comparative balance sheet for Halpern Corporation is presented below: Additional information: 1. Net loss for 2020 is $20,000. 2. Cash dividends of $14,000 were declared and paid in 2020 . 3. Land was sold for cash at a loss of $4,000. This was the only land transaction during the year. 4. Equipment with a cost of $15,000 and accumulated depreciation of $10,000 was sold for $5,000 cash. 5. $22,000 of bonds were retired during the year at carrying (book) value. 6. Equipment was acquired for common stock. The fair value of the stock at the time of the exchange was $25,00 Prepare a statement of cash flows for the year ended 2020 , using the indirect method. (Show amounts that decrease cash flow with either HALPERN CORPORATION Statement of Cash Flows Adjustments to reconcile net income to $ Save for Later $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts