Question: ( a ) Compare mean - variance analysis and stochastic dominance for choosing risky projects, taking care to define any notation you use ( b

a Compare meanvariance analysis and stochastic dominance for

choosing risky projects, taking care to define any notation you

use

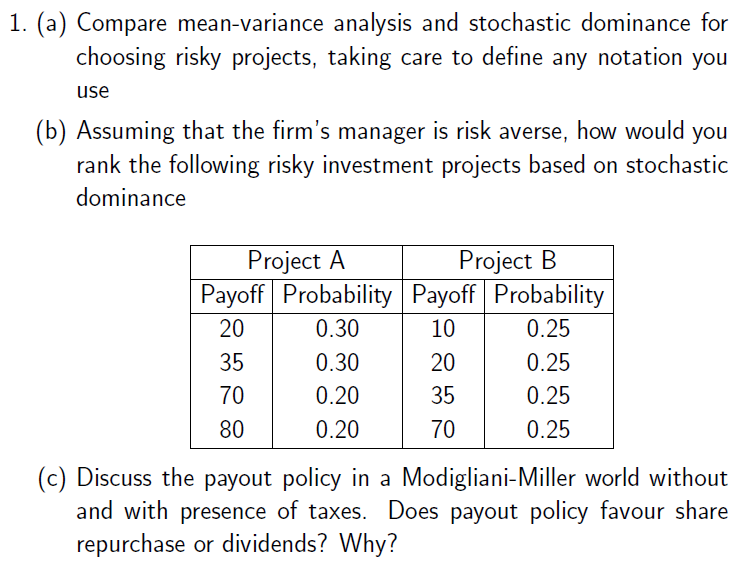

b Assuming that the firm's manager is risk averse, how would you

rank the following risky investment projects based on stochastic

dominance

c Discuss the payout policy in a ModiglianiMiller world without

and with presence of taxes. Does payout policy favour share

repurchase or dividends? Why?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock