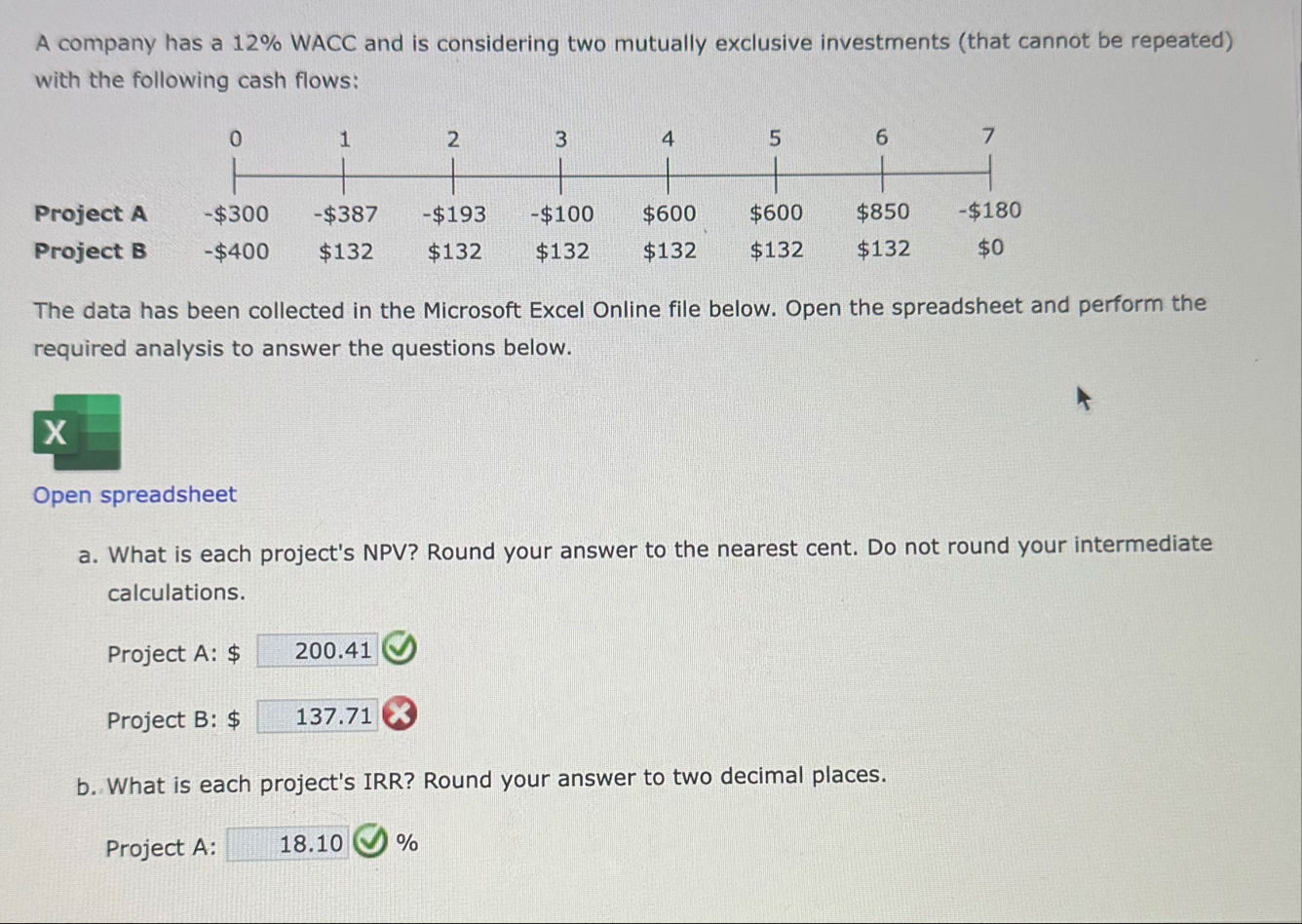

Question: A compary has a 1 2 4 WACC and is conpidering two mutually exclusive irvestments ( that cannot be repeated ) with the following cash

A compary has a WACC and is conpidering two mutually exclusive irvestments that cannot be repeated with the following cash flows:

The data has been collected in the Hicrosof Ewcel Onlise file belew. Open the spreadsheet and perform the recuired analyis to anower the questions below.

Open spreadsheet

What is each propect's APV lound your answer ts the nearent cent. De not round ybur intermedate calculations.

Project A:

Project E

b What is each project's IRR? Round your answer to two decimal places.

Project A: A company has a WACC and is considering two mutually exclusive investments that cannot be repeated with the following cash flows:

The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below.

Open spreadsheet

a What is each project's NPV Round your answer to the nearest cent. Do not round your intermediate calculations.

Project A: $

Project B: $

b What is each project's IRR? Round your answer to two decimal places.

Project A: b What is each project's IRR? Round your answer to two decimal places.

Project A:

Project B:

c What is each project's MIRR? Hint: Consider Period as the end of Project Bs life. Round your answer to two decimal places. Do not round your intermediate calculations.

Project A:

Project B:

d From your answers to parts ac which project would be selected?

If the WACC was which project would be selected?

e Construct NPV profiles for Projects A and B Round your answers to the nearest cent. Do not round your intermediate calculations. Negative value should be indicated by a minus sign.

Discount Rate

NPV Project A

NPV Project B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock