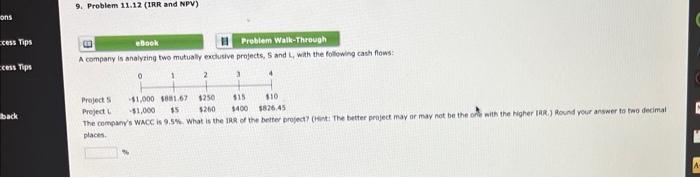

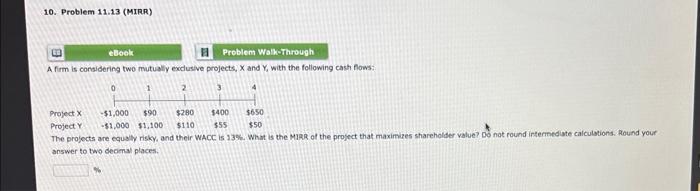

Question: A compeny is analyzing two mutusly eachueive projects, 5 and 4 , with the following cash fows: daces. A firm is considering two mutually exdusive

A compeny is analyzing two mutusly eachueive projects, 5 and 4 , with the following cash fows: daces. A firm is considering two mutually exdusive projects, X and Yi with the following cash flows: The projocts are equally risky, and their WACC is 13%. What is the MapR of the project that maximires shareholder value? Do not round intermedate calculations. Alound your answer to two decmal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts