Question: a ) Compere and contras Orrency future and forward contrast b ) The current spot rate of the USD is TZ 1 , 5 0

a Compere and contras

Orrency future and forward contrast

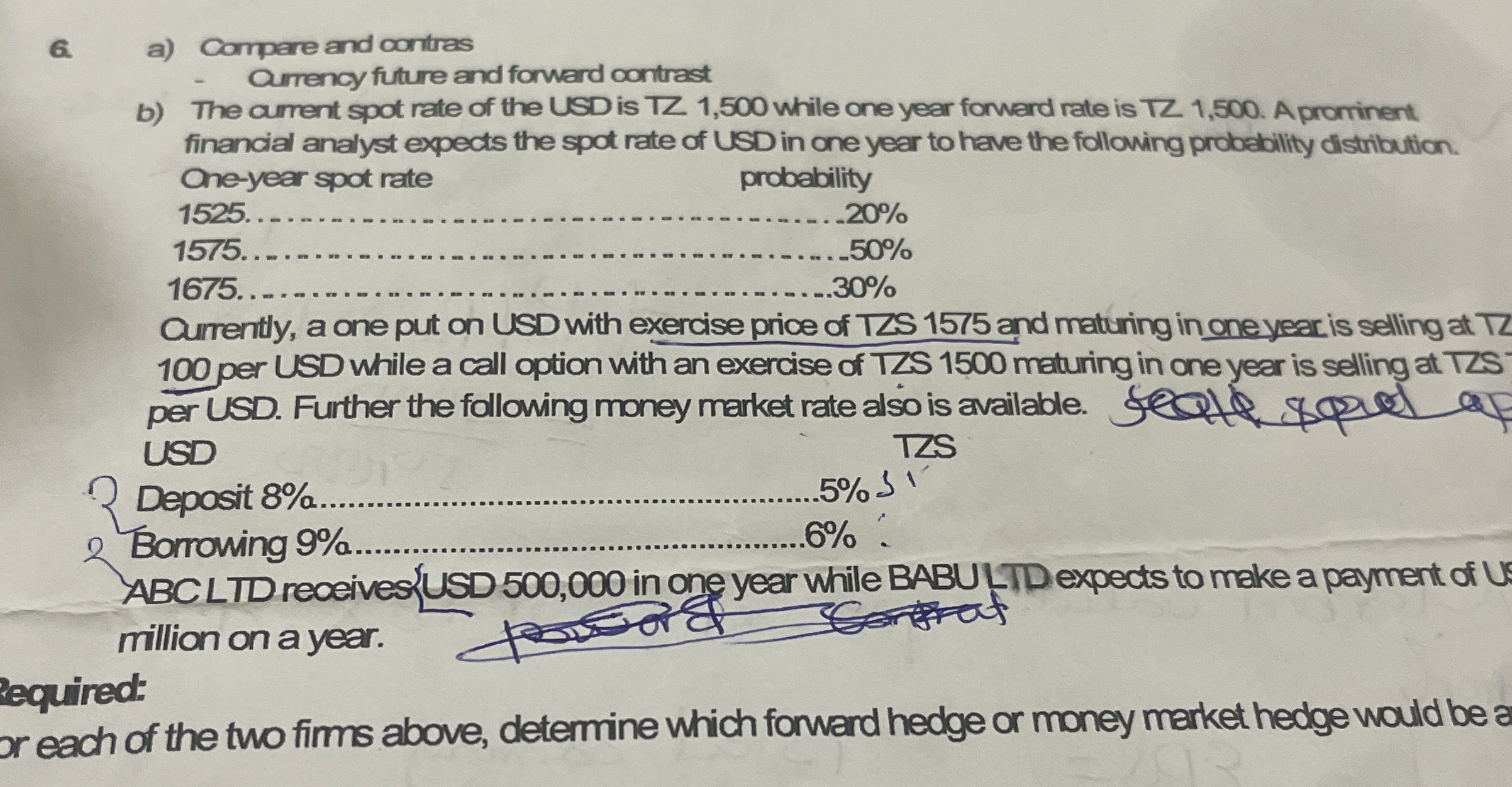

b The current spot rate of the USD is TZ while one year formerd rate is TZ A prominent financial analyst expects the spot rate of USD in one year to have the following probebility distribution.

Oneyear spot rate probability

Qurrently, a one put on USD with exercise price of TZS and maturing in one year is selling at per USD while a call option with an exercise of TZS maturing in one year is selling at TZS per USD. Further the following money market rate also is available. USD

Reposit S

Borrowing ABCLTD receivesUSD in one year while BABU TTD expects to make a payment of million on a year.

or&

Pequired:

reach of the two firms above, determine which forward hedge or money market hedge would be a

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock