Question: a. Complete the attached worksheet b. After completing the attached worksheet (part a) create an income statement and a balance sheet. 1. The business opened

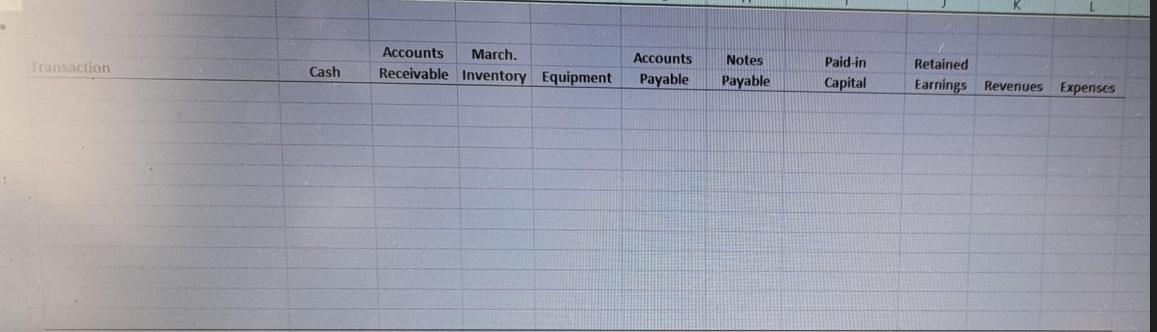

a. Complete the attached worksheet

b. After completing the attached worksheet (part a) create an income statement and a balance sheet.

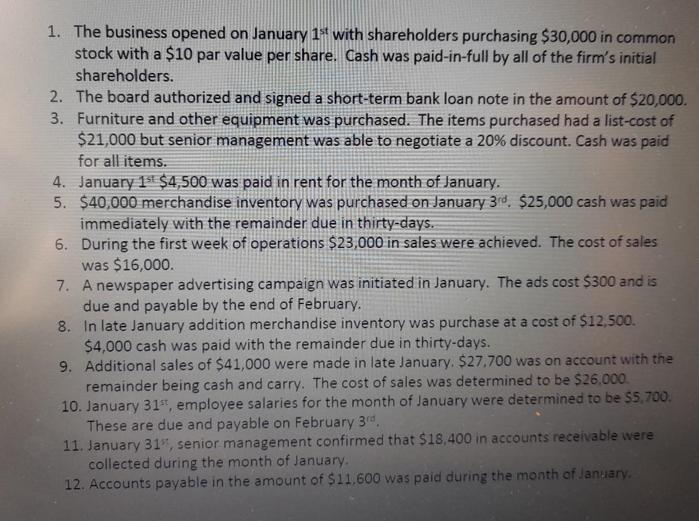

1. The business opened on January 1st with shareholders purchasing $30,000 in common stock with a $10 par value per share. Cash was paid-in-full by all of the firm's initial shareholders. 2. The board authorized and signed a short-term bank loan note in the amount of $20,000. 3. Furniture and other equipment was purchased. The items purchased had a list-cost of $21,000 but senior management was able to negotiate a 20% discount. Cash was paid for all items. 4. 5. January 1st $4,500 was paid in rent for the month of January. $40,000 merchandise inventory was purchased on January 3rd. $25,000 cash was paid immediately with the remainder due in thirty-days. 6. During the first week of operations $23,000 in sales were achieved. The cost of sales was $16,000. 7. A newspaper advertising campaign was initiated in January. The ads cost $300 and is due and payable by the end of February. 8. In late January addition merchandise inventory was purchase at a cost of $12,500. $4,000 cash was paid with the remainder due in thirty-days. 9. Additional sales of $41,000 were made in late January. $27.700 was on account with the remainder being cash and carry. The cost of sales was determined to be $26,000. 10. January 31st, employee salaries for the month of January were determined to be $5,700. These are due and payable on February 3rd, 11. January 31", senior management confirmed that $18,400 in accounts receivable were collected during the month of January. 12. Accounts payable in the amount of $11.600 was paid during the month of January.

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step 1 Accounting Equation It is the equivalence between the assets liabilities and equity Assets Li... View full answer

Get step-by-step solutions from verified subject matter experts