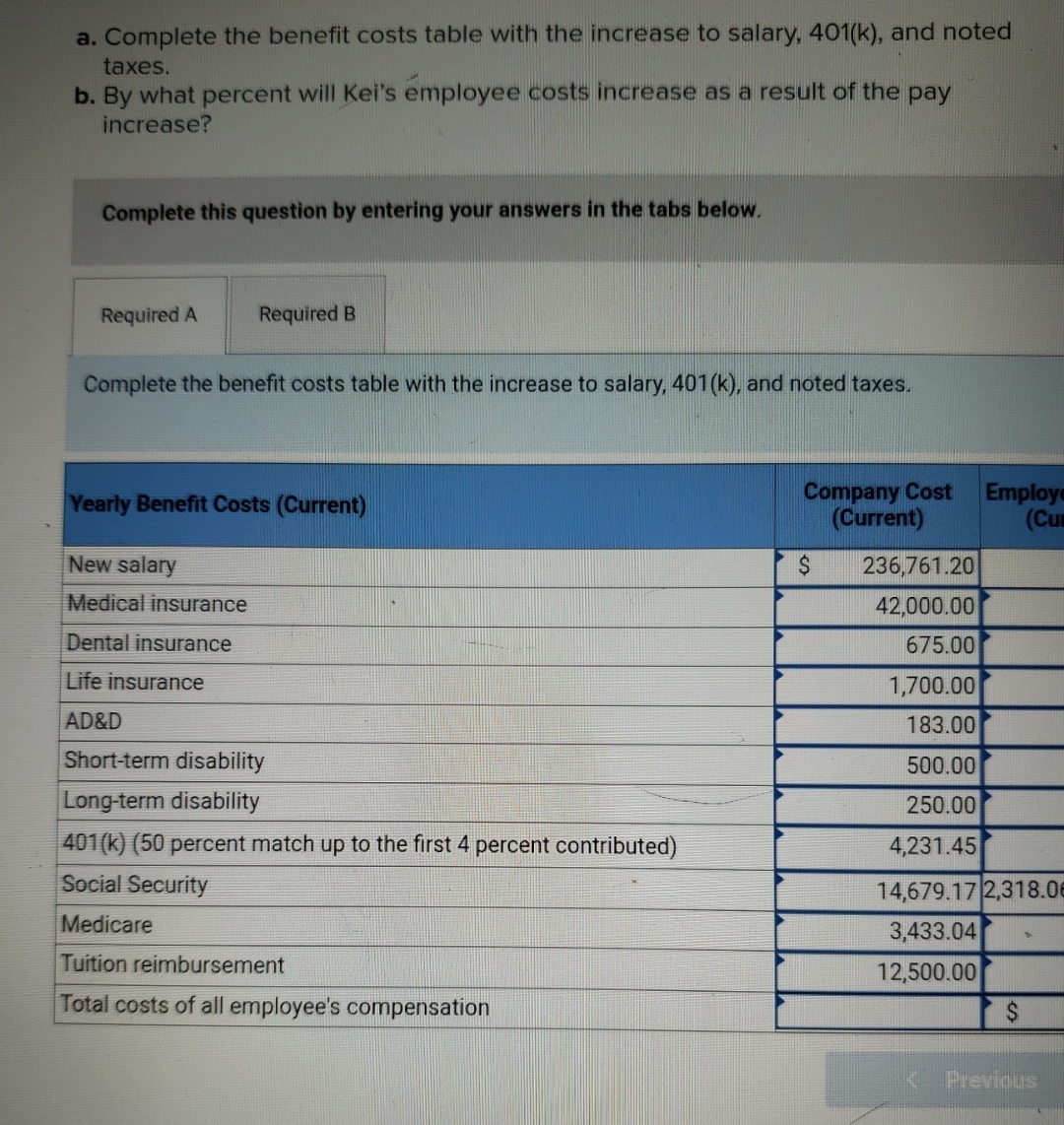

Question: a . Complete the benefit costs table with the increase to salary, 4 0 1 ( k ) , and noted taxes. b . By

a Complete the benefit costs table with the increase to salary, and noted taxes.

b By what percent will Kei's employee costs increase as a result of the pay increase?

Complete this question by entering your answers in the tabs below.

Required A

Complete the benefit costs table with the increase to salary, and noted taxes.

tableYearly Benefit Costs CurrentCompany Cost CurrentEmploy CuiNew salary,$ Medical insurance,Dental insurance,Life insurance,AD&DShortterm disability,Longterm disability,k percent match up to the first percent contributedSocial Security,MedicareTuition reimbursement,Total costs of all employee's compensation,,$

Previous

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock