Question: a . Complete the statements below regarding the purpose and requirements for a stock redemption to pay death taxes. A redemption to pay death taxes

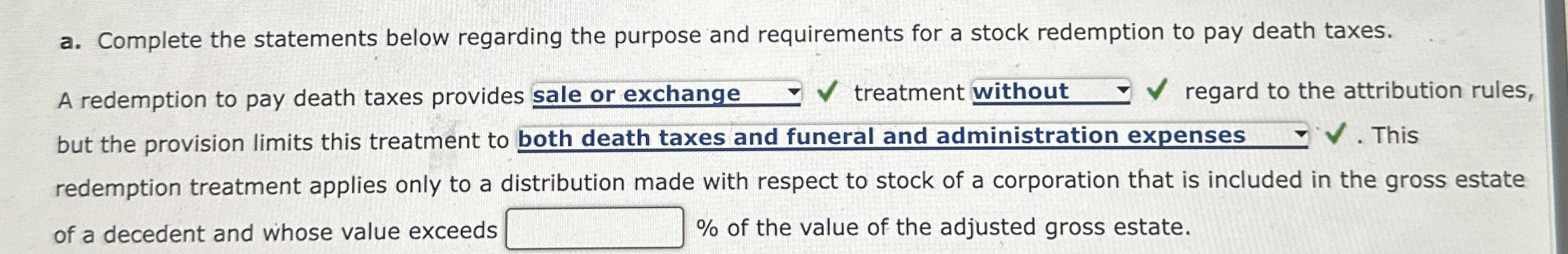

a Complete the statements below regarding the purpose and requirements for a stock redemption to pay death taxes.

A redemption to pay death taxes provides sale or exchange treatment without

regard to the attribution rules, but the provision limits this treatment to both death taxes and funeral and administration expenses This redemption treatment applies only to a distribution made with respect to stock of a corporation that is included in the gross estate of a decedent and whose value exceeds of the value of the adjusted gross estate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock