Question: A computational process is required (Excel is not allowed) QUESTION 1 Value At RISK (Va R) Individual assets and Portfolios (TOTAL 15 Marks) Capital invested.

A computational process is required (Excel is not allowed)

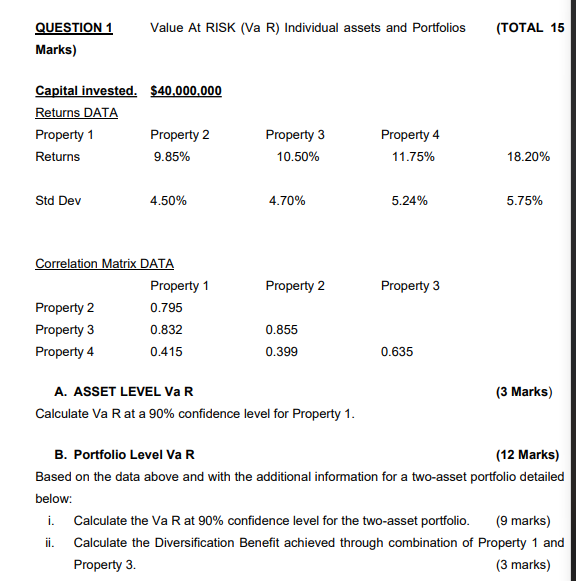

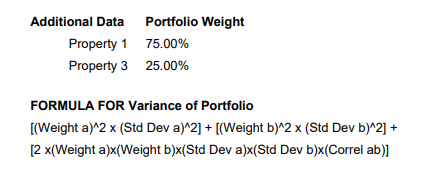

QUESTION 1 Value At RISK (Va R) Individual assets and Portfolios (TOTAL 15 Marks) Capital invested. $40,000,000 Returns DATA Property 1 Property 2 Property 3 Property 4 Returns 9.85% 10.50% 11.75% 18.20% Std Dev 4.50% 4.70% 5.24% 5.75% Correlation Matrix DATA Property 1 Property 2 Property 3 Property 2 0.795 Property 3 0.832 0.855 Property 4 0.415 0.399 0.635 (3 Marks) A. ASSET LEVEL VAR Calculate Va R at a 90% confidence level for Property 1. B. Portfolio Level VaR (12 Marks) Based on the data above and with the additional information for a two-asset portfolio detailed below: i. Calculate the VaR at 90% confidence level for the two-asset portfolio. (9 marks) ii. Calculate the Diversification Benefit achieved through combination of Property 1 and Property 3. (3 marks) Additional Data Portfolio Weight Property 1 75.00% Property 3 25.00% FORMULA FOR Variance of Portfolio [(Weight a) 2 x (Std Dev a)"2] + [(Weight b)^2 x (Std Dev b)^2] + [2 x(Weight a)x(Weight b)x(Std Dev a)x(Std Dev b)x(Correl ab)] QUESTION 1 Value At RISK (Va R) Individual assets and Portfolios (TOTAL 15 Marks) Capital invested. $40,000,000 Returns DATA Property 1 Property 2 Property 3 Property 4 Returns 9.85% 10.50% 11.75% 18.20% Std Dev 4.50% 4.70% 5.24% 5.75% Correlation Matrix DATA Property 1 Property 2 Property 3 Property 2 0.795 Property 3 0.832 0.855 Property 4 0.415 0.399 0.635 (3 Marks) A. ASSET LEVEL VAR Calculate Va R at a 90% confidence level for Property 1. B. Portfolio Level VaR (12 Marks) Based on the data above and with the additional information for a two-asset portfolio detailed below: i. Calculate the VaR at 90% confidence level for the two-asset portfolio. (9 marks) ii. Calculate the Diversification Benefit achieved through combination of Property 1 and Property 3. (3 marks) Additional Data Portfolio Weight Property 1 75.00% Property 3 25.00% FORMULA FOR Variance of Portfolio [(Weight a) 2 x (Std Dev a)"2] + [(Weight b)^2 x (Std Dev b)^2] + [2 x(Weight a)x(Weight b)x(Std Dev a)x(Std Dev b)x(Correl ab)]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts