Question: a. Compute: 1. Direct materials. 2. Direct labor. 3. Fixed Manufacturing overhead. 4. Variable manufacturing overhead. 5. Total manufacturing costs. 6. Prime cost. 7. Conversion

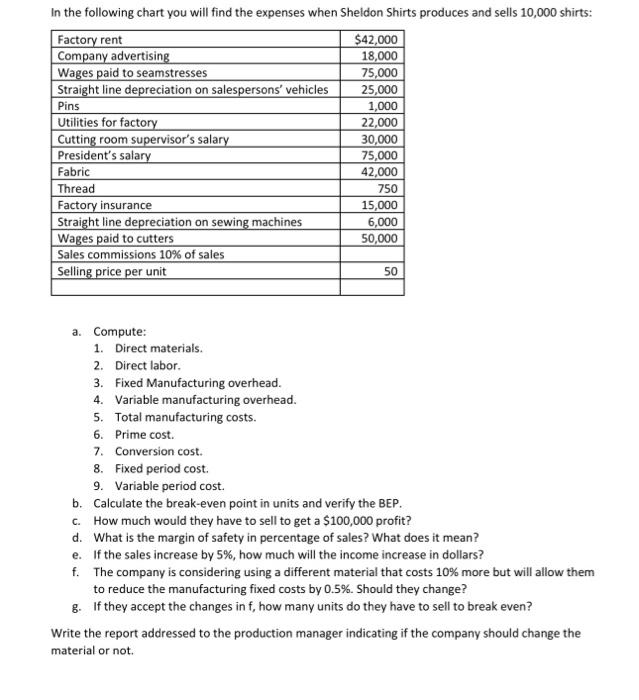

a. Compute: 1. Direct materials. 2. Direct labor. 3. Fixed Manufacturing overhead. 4. Variable manufacturing overhead. 5. Total manufacturing costs. 6. Prime cost. 7. Conversion cost. 8. Fixed period cost. 9. Variable period cost. b. Calculate the break-even point in units and verify the BEP. c. How much would they have to sell to get a $100,000 profit? d. What is the margin of safety in percentage of sales? What does it mean? e. If the sales increase by 5%, how much will the income increase in dollars? f. The company is considering using a different material that costs 10% more but will allow them to reduce the manufacturing fixed costs by 0.5%. Should they change? g. If they accept the changes in f, how many units do they have to sell to break even? Write the report addressed to the production manager indicating if the company should change the material or not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts