Question: a) Compute all ratios in the ratios tab. (as we did for EPI on page 6 of this lecture note) b) Identify two ratios that

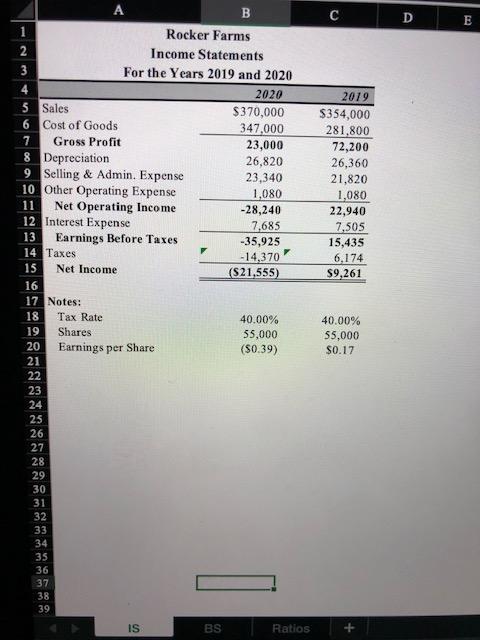

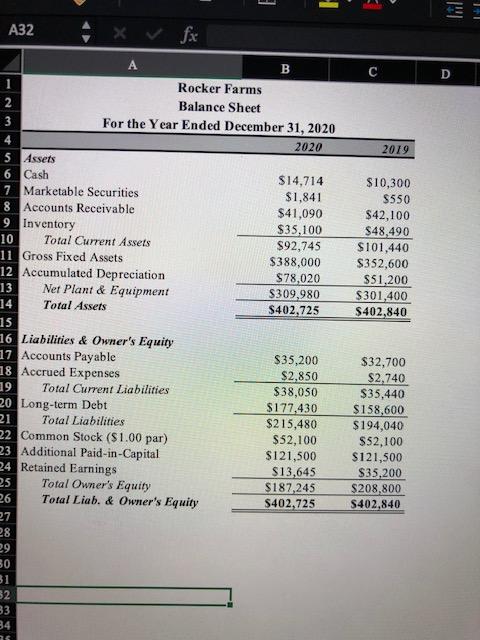

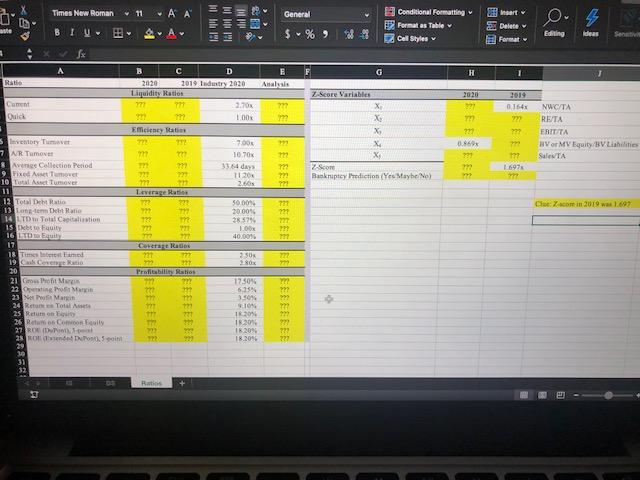

a) Compute all ratios in the ratios tab. (as we did for EPI on page 6 of this lecture note)

b) Identify two ratios that indicate positive things about this company. There is no need of industry comparison for this.

c) Identify two ratios that indicate negative things about this company. There is no need of industry comparison for this.

d) Is this company heading in the right or direction based on ratio analysis?

e) Compute the relevant Z-score for this company. Is this company going to be bankrupt in the next one year (yeso/maybe)?

C D E A B 1 Rocker Farms 2 Income Statements 3 For the Years 2019 and 2020 4 2020 5 Sales $370,000 6 Cost of Goods 347,000 7 Gross Profit 23,000 8 Depreciation 26,820 9 Selling & Admin. Expense 23,340 10 Other Operating Expense 1,080 11 Net Operating Income -28,240 12 Interest Expense 7,685 13 Earnings Before Taxes -35,925 14 Taxes -14,370 15 Net Income (S21,555) 16 17 Notes: 18 Tax Rate 40.00% 19 Shares 55,000 20 Earnings per Share (S0.39) 21 22 2019 $354,000 281,800 72,200 26,360 21,820 1,080 22,940 7,505 15,435 6.174 $9,261 40.00% 55,000 $0.17 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 IS BS Ratios + E A32 D 2019 A B 1 Rocker Farms 2 Balance Sheet 3 For the Year Ended December 31, 2020 2020 5 Assets 6 Cash $14,714 7 Marketable Securities $1,841 8 Accounts Receivable $41,090 9 Inventory $35,100 10 Total Current Assets $92,745 11 Gross Fixed Assets $388,000 12 Accumulated Depreciation $78,020 13 Net Plant & Equipment S309,980 14 Total Assets $402,725 15 16 Liabilities & Owner's Equity 17 Accounts Payable S35,200 18 Accrued Expenses $2,850 19 Total Current Liabilities $38,050 20 Long-term Debt $177,430 21 Total Liabilities $215,480 22 Common Stock ($1.00 par) $52,100 23 Additional Paid-in-Capital $121,500 24 Retained Earnings $13,645 25 Total Owner's Equity $187,245 26 Total Liab. & Owner's Equity $402,725 27 28 29 $10,300 $550 $42,100 $48,490 $101,440 $352,600 $51,200 $301,400 $402,840 $32,700 $2,740 $35,440 $ 158,600 $ 194,040 S52,100 $121,500 $35,200 $208,800 $402,840 31 2 33 34 5 Times New Roman 11 + AA General in HU lullllll Conditional Formatting Formatas Table Cell Styles o. 4 we BIU A $ %) 9 2 Delete Format Editing Ideas Sot * A G 1 Rate Analysis 1019 0.154 Cat Quick 2 Score Variables X X X X X 2020 377 yu 977 0.869 293 192 999 NWCATA RETA FRITTA HVOR MV Equity BV Liabilities Sales TA lity Turvet 7 NR Tumor Avenge Collection Period 9 Fixed Auto 10 Total Asset Tove 77 1 6973 B C D 2020 2019 Tedustry 2020 Liquidity Ratios 972 2.70 1.00 Efficiency Rati T2 700 10.70% m 11.20 2.60 Leverage Rate 50.00 20.00% 28.57% 21 100 40.001 Coverage Rates 2 SUR 21 BOX Profitability to 22 12509 2 Score Bankruptcy Prediction (Yes Maybe No) BEEEEEEEEEEEEEEEEEEEE 727 12 Total Debt Ratio 13 Lonem Debt Ratio 14 LTD Total Capitalistion 15th it 16 LTD 17 18 Times best med 19k Cerca Radio 10 21 Growlit M 22 PM 23 Martin 24 Rete Totale 25 Reumoni 26 RunComorosity 27 RON 28 Oro 5 29 30 31 32 Checa in 2019 war 1.697 EEEEEEEEEEEEEEEEEEEEE 17 27 3.504 1044 12. 20% 18.2014 18.20% 120 Ratio C D E A B 1 Rocker Farms 2 Income Statements 3 For the Years 2019 and 2020 4 2020 5 Sales $370,000 6 Cost of Goods 347,000 7 Gross Profit 23,000 8 Depreciation 26,820 9 Selling & Admin. Expense 23,340 10 Other Operating Expense 1,080 11 Net Operating Income -28,240 12 Interest Expense 7,685 13 Earnings Before Taxes -35,925 14 Taxes -14,370 15 Net Income (S21,555) 16 17 Notes: 18 Tax Rate 40.00% 19 Shares 55,000 20 Earnings per Share (S0.39) 21 22 2019 $354,000 281,800 72,200 26,360 21,820 1,080 22,940 7,505 15,435 6.174 $9,261 40.00% 55,000 $0.17 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 IS BS Ratios + E A32 D 2019 A B 1 Rocker Farms 2 Balance Sheet 3 For the Year Ended December 31, 2020 2020 5 Assets 6 Cash $14,714 7 Marketable Securities $1,841 8 Accounts Receivable $41,090 9 Inventory $35,100 10 Total Current Assets $92,745 11 Gross Fixed Assets $388,000 12 Accumulated Depreciation $78,020 13 Net Plant & Equipment S309,980 14 Total Assets $402,725 15 16 Liabilities & Owner's Equity 17 Accounts Payable S35,200 18 Accrued Expenses $2,850 19 Total Current Liabilities $38,050 20 Long-term Debt $177,430 21 Total Liabilities $215,480 22 Common Stock ($1.00 par) $52,100 23 Additional Paid-in-Capital $121,500 24 Retained Earnings $13,645 25 Total Owner's Equity $187,245 26 Total Liab. & Owner's Equity $402,725 27 28 29 $10,300 $550 $42,100 $48,490 $101,440 $352,600 $51,200 $301,400 $402,840 $32,700 $2,740 $35,440 $ 158,600 $ 194,040 S52,100 $121,500 $35,200 $208,800 $402,840 31 2 33 34 5 Times New Roman 11 + AA General in HU lullllll Conditional Formatting Formatas Table Cell Styles o. 4 we BIU A $ %) 9 2 Delete Format Editing Ideas Sot * A G 1 Rate Analysis 1019 0.154 Cat Quick 2 Score Variables X X X X X 2020 377 yu 977 0.869 293 192 999 NWCATA RETA FRITTA HVOR MV Equity BV Liabilities Sales TA lity Turvet 7 NR Tumor Avenge Collection Period 9 Fixed Auto 10 Total Asset Tove 77 1 6973 B C D 2020 2019 Tedustry 2020 Liquidity Ratios 972 2.70 1.00 Efficiency Rati T2 700 10.70% m 11.20 2.60 Leverage Rate 50.00 20.00% 28.57% 21 100 40.001 Coverage Rates 2 SUR 21 BOX Profitability to 22 12509 2 Score Bankruptcy Prediction (Yes Maybe No) BEEEEEEEEEEEEEEEEEEEE 727 12 Total Debt Ratio 13 Lonem Debt Ratio 14 LTD Total Capitalistion 15th it 16 LTD 17 18 Times best med 19k Cerca Radio 10 21 Growlit M 22 PM 23 Martin 24 Rete Totale 25 Reumoni 26 RunComorosity 27 RON 28 Oro 5 29 30 31 32 Checa in 2019 war 1.697 EEEEEEEEEEEEEEEEEEEEE 17 27 3.504 1044 12. 20% 18.2014 18.20% 120 Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts