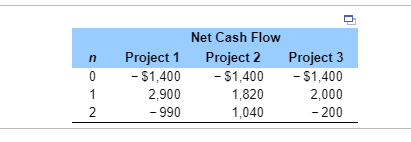

Question: (a) Compute i* for each investment. If the problem has more than one i*, identify all of them. Compute i * for Project 1. Select

(a) Compute i* for each investment. If the problem has more than one i*, identify all of them.

Compute i* for Project 1. Select the correct choice below and, if necessary, fill in the the answer box(es) to complete your answer.

A.Project 1 has a unique positive i* of ____%. (Round to one decimal place.)

B.Project 1 has two positive i* values:___% and ____%. (Round to one decimal place. Enter values in ascending order.)

C.Project 1 has no positive i* value.

Compute i* for Project 2. Select the correct choice below and, if necessary, fill in the the answer box(es) to complete your answer.

A.Project 2 has a unique positive i* of ____%. (Round to one decimal place.)

B.Project 2 has two positive i* values:___% and ____%. (Round to one decimal place. Enter values in ascending order.)

C.Project 2 has no positive i* value.

Compute i* for Project 3. Select the correct choice below and, if necessary, fill in the the answer box(es) to complete your answer.

A.Project 3 has a unique positive i* of ____%. (Round to one decimal place.)

B.Project 3 has two positive i* values:___% and ____%. (Round to one decimal place. Enter values in ascending order.)

C.Project 3 has no positive i* value.

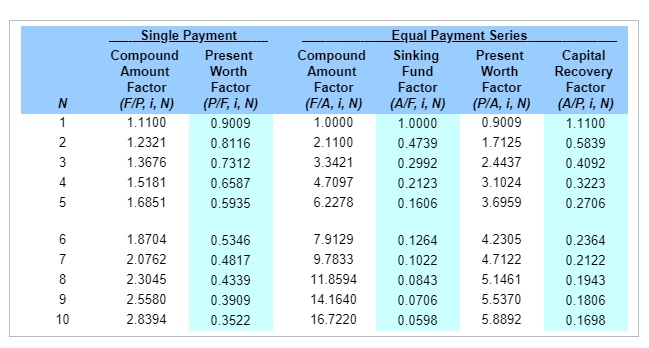

(b) Compute IRR(true) for each project. Assume MARR=12%.(Round to one decimal place.)

| IRR | ||

| Project 1 | ___% | |

| Project 2 | ___% | |

| Project 3 | ___% | |

(c) Compute the MIRR at MARR=12%. Assume the firm's financing cost is also 12%. (Round to one decimal place.)

| MIRR | ||

| Project 1 | ___% | |

| Project 2 | ___% | |

| Project 3 | ___% | |

(d) Determine the acceptability of each investment. Select the correct choices from the drop-down menus below.

| Accept of reject? | ||

| Project 1 | Accept or Reject | |

| Project 2 | Accept or Reject | |

| Project 3 | Accept or Reject | |

Net Cash Flow n Project 1 Project 2 Project 3 0-$1,400 -$1,400$1,400 2,000 - 200 2,900 - 990 1,820 1,040 . 09236 368 9 039 ,180 , 11 55 40 32 F 10000 2211 95749 i, 0 2 3 2 5 102 679 31438 158 7 01233 , g-rN 09236 3 7 368 9 3 2 2 u nk u a F 0 4 2 2 1 11000 10000 ntrN 9340 00178 1 78 8 17 0137 12346 7 F 79146 t r N, 9 6 2 7 5 6799 130 01 395 433 8 The WF DI 0 0 0 0 0 00000 gntrN0 1 6 1 1 42504 785 770 80358 12222 12356 N12345 6789 10 Net Cash Flow n Project 1 Project 2 Project 3 0-$1,400 -$1,400$1,400 2,000 - 200 2,900 - 990 1,820 1,040 . 09236 368 9 039 ,180 , 11 55 40 32 F 10000 2211 95749 i, 0 2 3 2 5 102 679 31438 158 7 01233 , g-rN 09236 3 7 368 9 3 2 2 u nk u a F 0 4 2 2 1 11000 10000 ntrN 9340 00178 1 78 8 17 0137 12346 7 F 79146 t r N, 9 6 2 7 5 6799 130 01 395 433 8 The WF DI 0 0 0 0 0 00000 gntrN0 1 6 1 1 42504 785 770 80358 12222 12356 N12345 6789 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts