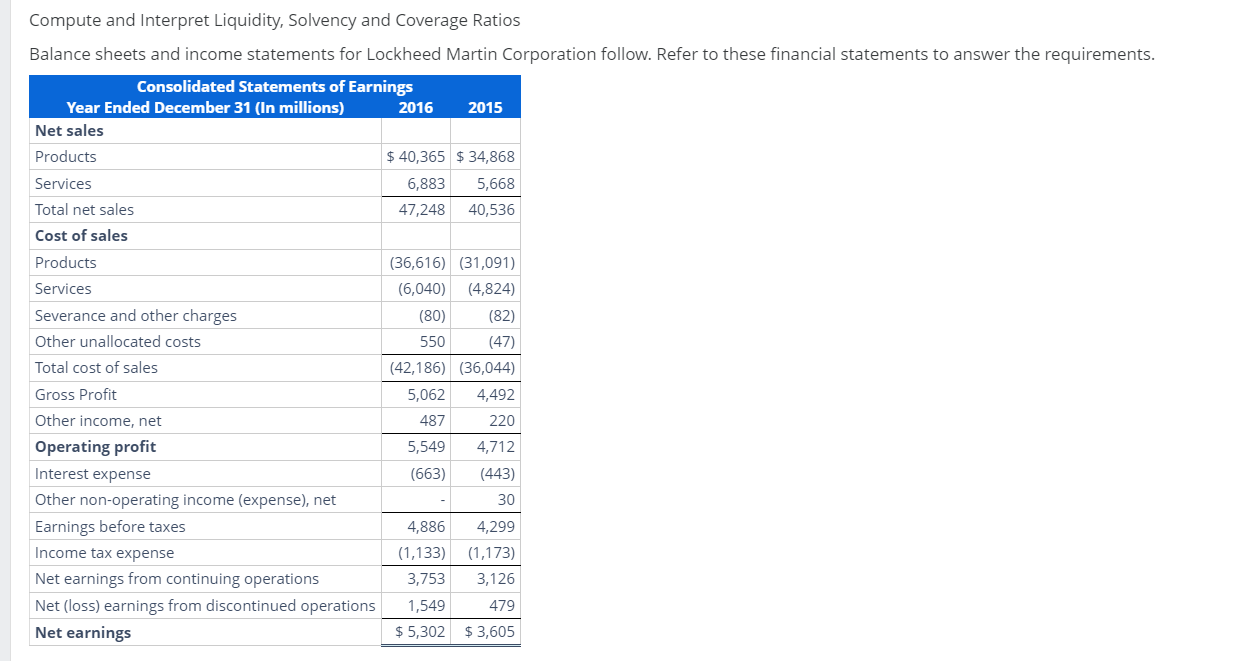

Question: ( a ) Compute Lockheed Martin's current ratio and quick ratio for 2 0 1 6 and 2 0 1 5 . ( Round your

a Compute Lockheed Martin's current ratio and quick ratio for and Round your answers to two decimal places.

current ratio

current ratio

quick ratio

quick ratio Answer

Which of the following best describes the company's current ratio and quick ratio for and

The current ratio has increased while the quick ratio has decreased in the period from to which suggests the company has a shortage of liquid assets.

Both the current and quick ratios have decreased from to however, the company is liquid.

Both the current and quick ratios have increased from to meaning the company is liquid.

The current ratio has decreased while the quick ratio has increased from to which suggests the company has a shortage of current assets.

b Compute total liabilitiestoequity ratios and total debttoequity ratios for and Round your answers to two decimal places.

total liabilitiestostockholders' equity

total liabilitiestostockholders' equity

total debttoequity

total debttoequity

Which of the following best describes the company's total liabilitiestoequity ratios and total debttoequity ratios for and

The total liabilitiestoequity ratio has decreased while the total debttoequity ratio has increased in the period from to which suggests the company has decreased the use of shortterm debt financing.

The total liabilitiestoequity ratio has increased while the total debttoequity ratio has decreased in the period from to which suggests the company has increased the use of shortterm debt financing.

Both the total liabilitiestoequity and total debttoequity ratios have increased from to These increases suggest that the company is less solvent.

Both the total liabilitiestoequity and total debttoequity ratios have decreased from to The difference between these two measures reveals that any solvency concerns would be for the short run.

c Compute times interest earned ratio, cash from operations to total debt ratio, and free operating cash flow to total debt ratios. Round your answers to two decimal places.

times interest earned

times interest earned

cash from operations to total debt

cash from operations to total debt

free operating cash flow to total debt

free operating cash flow to total debt

Which of the following describes the company's times interest earned, cash from operations to total debt, and free operating cash flow to total debt ratios for and Select all that apply

Lockheed Martin's free operating cash flow to total debt ratio slightly decreased over the year due to decreased cash flow from operations.

Lockheed Martin's times interest earned decreased during due an increase in interest expense.

Lockheed Martin's cash from operations to total debt ratio slightly increased over the year due to a decrease in total debt.

Lockheed Martin's times interest earned increased during due to an increase in profitability.

d Summarize your findings in a conclusion about the company's credit risk. Do you have any concerns about the company's ability to meet its debt obligations? Choose yes or No

Lockheed Martin's total debttoequity is low, thus increasing any immediate solvency concerns. The company's ability to meet its debt requirements will depend on increasing shortterm debt.

Lockheed Martin's quick ratio is low, thus increasing immediate solvency concerns. The company's ability to meet its debt requirements will depend on liquidating inventories for emergency cash.

Lockheed Martin's times interest earned ratio is strong, thus lessening any immediate solvency concerns. The company's ability to meet its debt requirements will depend on its continued profitability.

Lockheed Martin's total liabilitiestoequity is high, thus lessening any immediate solvency concerns. The company's ability to meet its debt requirements will depend on its use of equity financing.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock