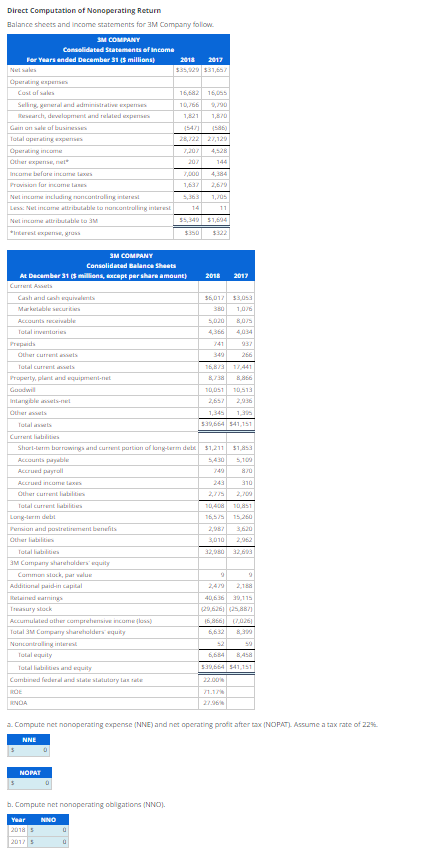

Question: a . Compute net nonoperating expense ( NNE ) and net operating profit after tax ( NOPAT ) . Assume a tax rate of 2

a Compute net nonoperating expense NNE and net operating profit after tax NOPAT Assume a tax rate of

NNE

Answer

NOPAT

Answer

b Compute net nonoperating obligations NNO

Year NNO

Answer

Answer

c Compute financial leverage FLEV

Numerator Denominator FLEV

Answer

Answer

Answer

Answer

d Compute NNEP and Spread.

Numerator Denominator NNEP

Answer

Answer

Answer

Answer

RNOA given NNEP Spread

Answer

Answer

e Compute the noncontrolling interest ratio NCI ratio

Numerator Denominator NCI ratio

Answer

Answer

f Confirm the relation: ROE RNOA FLEV times Spreadtimes NCI ratio.

Ratio Number

ROE given Answer

RNOA given Answer

FLEV Answer

Spread Answer

NCI ratio Answer

ROE

c Compute financlal leverage FLEV

d Compute NNEP and Spread.

e Compute the noncontrolling interest ratio NCI ratio

f Confirm the relation: ROE RNOA FLEV Spresd

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock