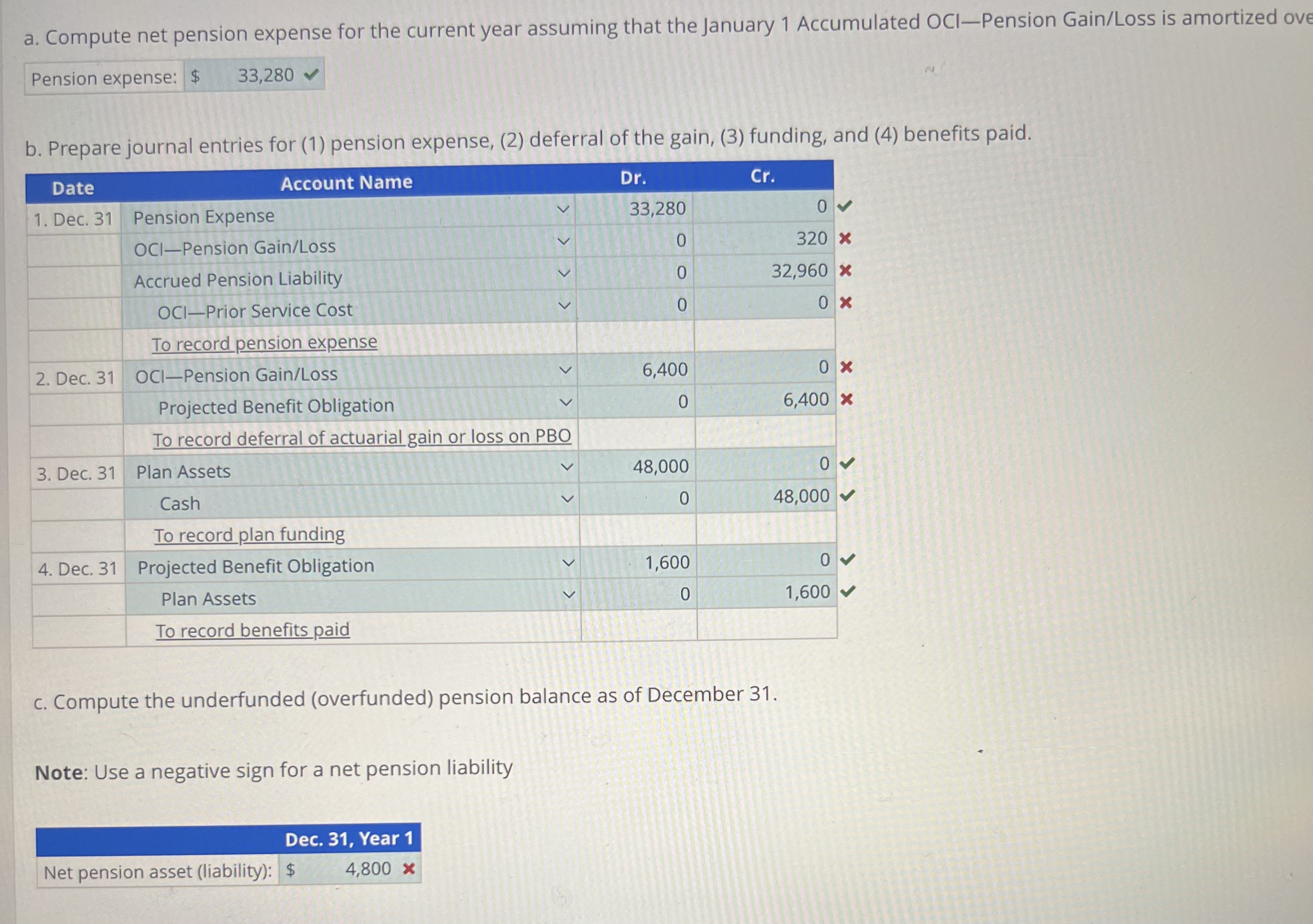

Question: a . Compute net pension expense for the current year assuming that the January 1 Accumulated OCI - Pension Gain / Loss is amortized ove

a Compute net pension expense for the current year assuming that the January Accumulated OCIPension GainLoss is amortized ove

Pension expense:

$

b Prepare journal entries for pension expense, deferral of the gain, funding, and benefits paid.

tableDateAccount Name,DrCr Dec. Pension Expense OClPension GainLossAccrued Pension Liability OClPrior Service Cost To record pension expense,, Dec. OClPension GainLossProjected Benefit Obligation To record deferral of actuarial gain or loss on PBO,, Dec. Plan Assets,Cash,To record plan funding,, Dec. Projected Benefit Obligation Plan Assets To record benefits paid,,

c Compute the underfunded overfunded pension balance as of December

Note: Use a negative sign for a net pension liability

tableDec. Year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock