Question: a. Compute Oracle's long-term debt to shareholders' equity ratio for May 31, 2008 and 2007. Identify the increases in shareholders' equity in 2008 from share-based

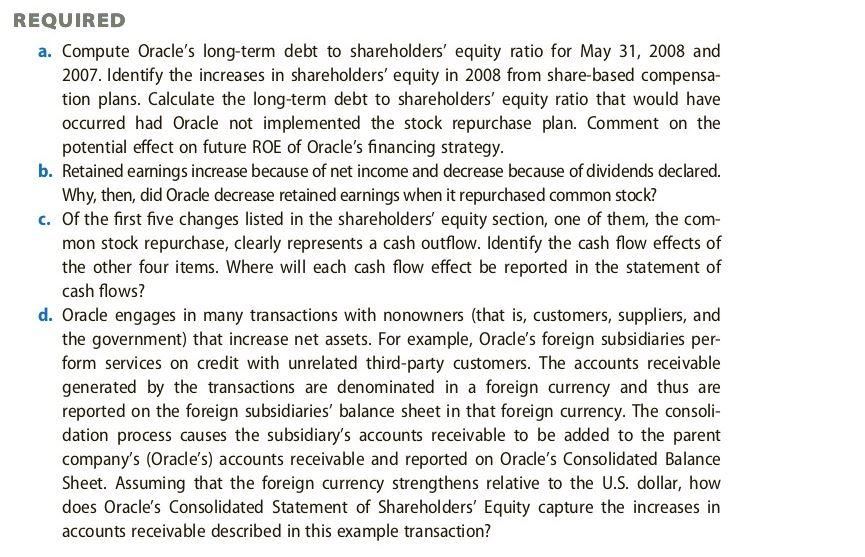

a. Compute Oracle's long-term debt to shareholders' equity ratio for May 31, 2008 and 2007. Identify the increases in shareholders' equity in 2008 from share-based compensation plans. Calculate the long-term debt to shareholders' equity ratio that would have occurred had Oracle not implemented the stock repurchase plan. Comment on the potential effect on future ROE of Oracle's financing strategy. b. Retained earnings increase because of net income and decrease because of dividends declared. Why, then, did Oracle decrease retained earnings when it repurchased common stock? c. Of the first five changes listed in the shareholders' equity section, one of them, the common stock repurchase, clearly represents a cash outflow. Identify the cash flow effects of the other four items. Where will each cash flow effect be reported in the statement of cash flows? d. Oracle engages in many transactions with nonowners (that is, customers, suppliers, and the government) that increase net assets. For example, Oracle's foreign subsidiaries perform services on credit with unrelated third-party customers. The accounts receivable generated by the transactions are denominated in a foreign currency and thus are reported on the foreign subsidiaries' balance sheet in that foreign currency. The consolidation process causes the subsidiary's accounts receivable to be added to the parent company's (Oracle's) accounts receivable and reported on Oracle's Consolidated Balance Sheet. Assuming that the foreign currency strengthens relative to the U.S. dollar, how does Oracle's Consolidated Statement of Shareholders' Equity capture the increases in accounts receivable described in this example transaction? a. Compute Oracle's long-term debt to shareholders' equity ratio for May 31, 2008 and 2007. Identify the increases in shareholders' equity in 2008 from share-based compensation plans. Calculate the long-term debt to shareholders' equity ratio that would have occurred had Oracle not implemented the stock repurchase plan. Comment on the potential effect on future ROE of Oracle's financing strategy. b. Retained earnings increase because of net income and decrease because of dividends declared. Why, then, did Oracle decrease retained earnings when it repurchased common stock? c. Of the first five changes listed in the shareholders' equity section, one of them, the common stock repurchase, clearly represents a cash outflow. Identify the cash flow effects of the other four items. Where will each cash flow effect be reported in the statement of cash flows? d. Oracle engages in many transactions with nonowners (that is, customers, suppliers, and the government) that increase net assets. For example, Oracle's foreign subsidiaries perform services on credit with unrelated third-party customers. The accounts receivable generated by the transactions are denominated in a foreign currency and thus are reported on the foreign subsidiaries' balance sheet in that foreign currency. The consolidation process causes the subsidiary's accounts receivable to be added to the parent company's (Oracle's) accounts receivable and reported on Oracle's Consolidated Balance Sheet. Assuming that the foreign currency strengthens relative to the U.S. dollar, how does Oracle's Consolidated Statement of Shareholders' Equity capture the increases in accounts receivable described in this example transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts