Question: a) Compute the basic earnings per share (EPS) and book value per share (BVPS). b) Compute the diluted earnings per share (EPS) and book value

a) Compute the basic earnings per share (EPS) and book value per share (BVPS).

b) Compute the diluted earnings per share (EPS) and book value per share (BVPS).

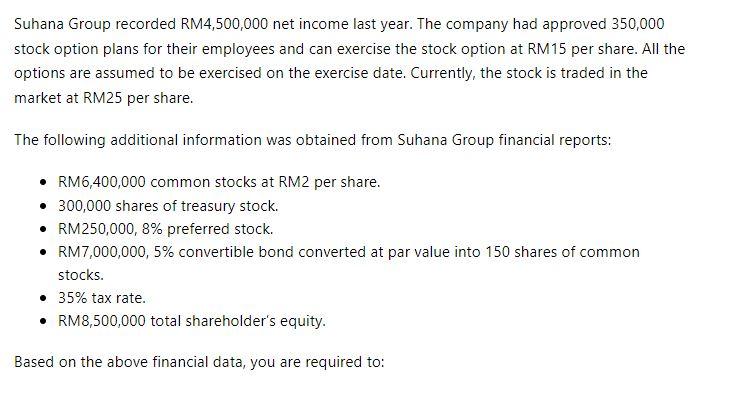

Suhana Group recorded RM4,500,000 net income last year. The company had approved 350,000 stock option plans for their employees and can exercise the stock option at RM15 per share. All the options are assumed to be exercised on the exercise date. Currently, the stock is traded in the market at RM25 per share. The following additional information was obtained from Suhana Group financial reports: RM6,400,000 common stocks at RM2 per share. 300,000 shares of treasury stock. RM250,000, 8% preferred stock. RM7,000,000, 5% convertible bond converted at par value into 150 shares of common stocks. 35% tax rate. RM8,500,000 total shareholder's equity. Based on the above financial data, you are required to: Suhana Group recorded RM4,500,000 net income last year. The company had approved 350,000 stock option plans for their employees and can exercise the stock option at RM15 per share. All the options are assumed to be exercised on the exercise date. Currently, the stock is traded in the market at RM25 per share. The following additional information was obtained from Suhana Group financial reports: RM6,400,000 common stocks at RM2 per share. 300,000 shares of treasury stock. RM250,000, 8% preferred stock. RM7,000,000, 5% convertible bond converted at par value into 150 shares of common stocks. 35% tax rate. RM8,500,000 total shareholder's equity. Based on the above financial data, you are required to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts