Question: a. Compute the beta and the expected return of each stock. b. Using your expected returns from part a and the portfolio weights below, calculate

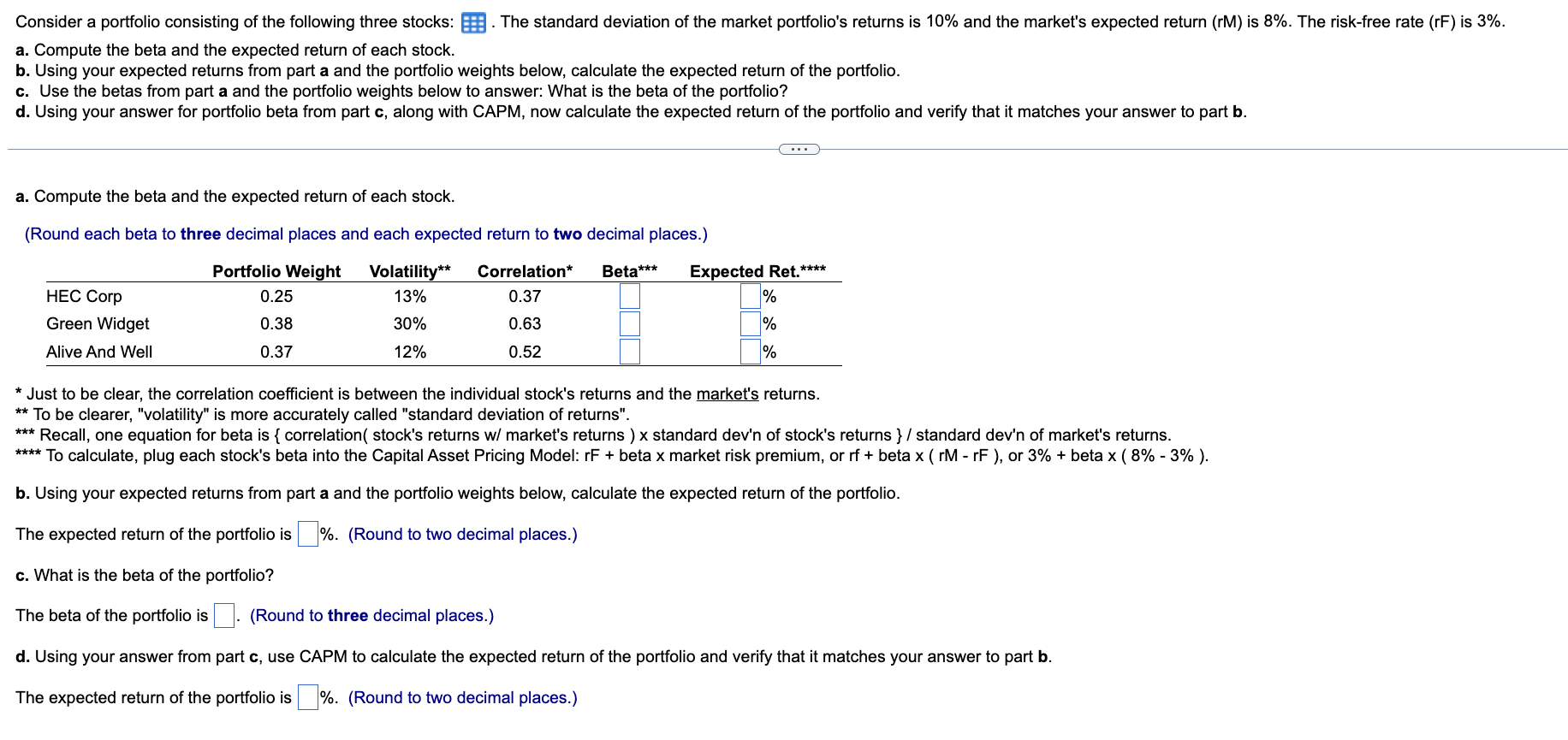

a. Compute the beta and the expected return of each stock. b. Using your expected returns from part a and the portfolio weights below, calculate the expected return of the portfolio. c. Use the betas from part a and the portfolio weights below to answer: What is the beta of the portfolio? d. Using your answer for portfolio beta from part c, along with CAPM, now calculate the expected return of the portfolio and verify that it matches your answer to part b. a. Compute the beta and the expected return of each stock. (Round each beta to three decimal places and each expected return to two decimal places.) * Just to be clear, the correlation coefficient is between the individual stock's returns and the market's returns. ** To be clearer, "volatility" is more accurately called "standard deviation of returns". Recall, one equation for beta is { correlation( stock's returns w/ market's returns ) x standard dev'n of stock's returns } / standard dev'n of market's returns. **** To calculate, plug each stock's beta into the Capital Asset Pricing Model: rF+ beta x market risk premium, or rf + beta x ( rM - rF ), or 3%+ beta x ( 8% - 3% ). b. Using your expected returns from part a and the portfolio weights below, calculate the expected return of the portfolio. The expected return of the portfolio is \%. (Round to two decimal places.) c. What is the beta of the portfolio? The beta of the portfolio is (Round to three decimal places.) d. Using your answer from part c, use CAPM to calculate the expected return of the portfolio and verify that it matches your answer to part b. The expected return of the portfolio is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts